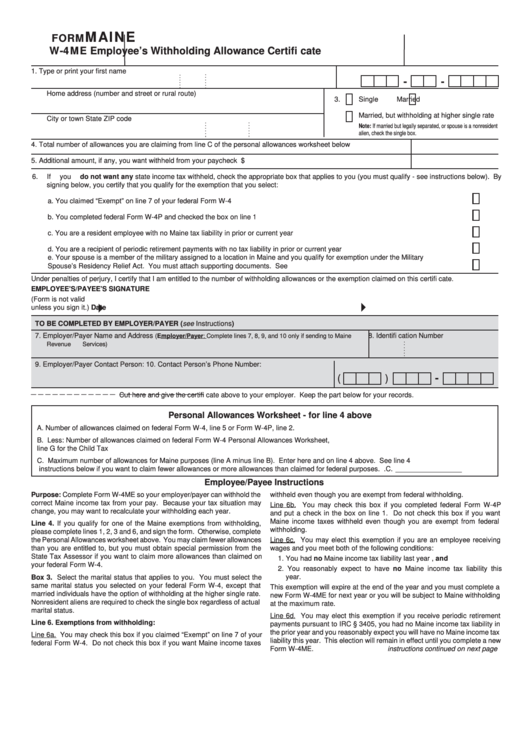

MAINE

FORM

W-4ME

Employee’s Withholding Allowance Certifi cate

1.

Type or print your fi rst name

M.I.

Last name

2. Your social security number

-

-

Home address (number and street or rural route)

3.

Single

Married

Married, but withholding at higher single rate

City or town

State

ZIP code

Note: If married but legally separated, or spouse is a nonresident

alien, check the single box

.

4.

Total number of allowances you are claiming from line C of the personal allowances worksheet below ..................... 4.

5.

Additional amount, if any, you want withheld from your paycheck ................................................................................ 5.

$

6.

If you do not want any state income tax withheld, check the appropriate box that applies to you (you must qualify - see instructions below). By

signing below, you certify that you qualify for the exemption that you select:

a.

You claimed “Exempt” on line 7 of your federal Form W-4 .................................................................................................................. 6a.

b.

You completed federal Form W-4P and checked the box on line 1 .................................................................................................... 6b.

c.

You are a resident employee with no Maine tax liability in prior or current year ................................................................................. 6c.

d.

You are a recipient of periodic retirement payments with no tax liability in prior or current year ........................................................ 6d.

e.

Your spouse is a member of the military assigned to a location in Maine and you qualify for exemption under the Military

Spouse’s Residency Relief Act. You must attach supporting documents. See instructions.............................................................. 6e.

Under penalties of perjury, I certify that I am entitled to the number of withholding allowances or the exemption claimed on this certifi cate.

EMPLOYEE’S/PAYEE’S SIGNATURE

(Form is not valid

unless you sign it.)

Date

TO BE COMPLETED BY EMPLOYER/PAYER (see Instructions)

7. Employer/Payer Name and Address

8. Identifi cation Number

(Employer/Payer: Complete lines 7, 8, 9, and 10 only if sending to Maine

Revenue Services)

9. Employer/Payer Contact Person:

10. Contact Person’s Phone Number:

-

(

(

_ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _

Cut here and give the certifi cate above to your employer. Keep the part below for your records.

Personal Allowances Worksheet - for line 4 above

A. Number of allowances claimed on federal Form W-4, line 5 or Form W-4P, line 2. ................................................................A. _________________

B. Less: Number of allowances claimed on federal Form W-4 Personal Allowances Worksheet,

line G for the Child Tax Credit..................................................................................................................................................B. _________________

C. Maximum number of allowances for Maine purposes (line A minus line B). Enter here and on line 4 above. See line 4

instructions below if you want to claim fewer allowances or more allowances than claimed for federal purposes. ................C. _________________

Employee/Payee Instructions

Purpose: Complete Form W-4ME so your employer/payer can withhold the

withheld even though you are exempt from federal withholding.

correct Maine income tax from your pay. Because your tax situation may

Line 6b. You may check this box if you completed federal Form W-4P

change, you may want to recalculate your withholding each year.

and put a check in the box on line 1. Do not check this box if you want

Maine income taxes withheld even though you are exempt from federal

Line 4. If you qualify for one of the Maine exemptions from withholding,

withholding.

please complete lines 1, 2, 3 and 6, and sign the form. Otherwise, complete

Line 6c. You may elect this exemption if you are an employee receiving

the Personal Allowances worksheet above. You may claim fewer allowances

than you are entitled to, but you must obtain special permission from the

wages and you meet both of the following conditions:

State Tax Assessor if you want to claim more allowances than claimed on

1. You had no Maine income tax liability last year , and

your federal Form W-4.

2. You reasonably expect to have no Maine income tax liability this

year.

Box 3. Select the marital status that applies to you. You must select the

same marital status you selected on your federal Form W-4, except that

This exemption will expire at the end of the year and you must complete a

married individuals have the option of withholding at the higher single rate.

new Form W-4ME for next year or you will be subject to Maine withholding

Nonresident aliens are required to check the single box regardless of actual

at the maximum rate.

marital status.

Line 6d. You may elect this exemption if you receive periodic retirement

Line 6. Exemptions from withholding:

payments pursuant to IRC § 3405, you had no Maine income tax liability in

the prior year and you reasonably expect you will have no Maine income tax

Line 6a. You may check this box if you claimed “Exempt” on line 7 of your

liability this year. This election will remain in effect until you complete a new

federal Form W-4. Do not check this box if you want Maine income taxes

Form W-4ME.

instructions continued on next page

1

1 2

2