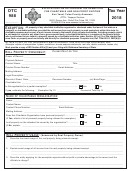

Homestead Form Mailing Instructions

YOU MUST OWN AND ESTABLISH YOUR PERMANENT RESIDENCE ON THE

PROPERTY PRIOR TO JANUARY 1, 2018 AND YOU MUST PROVIDE COPIES (front and

back) OF THE FOLLOWING DOCUMENTATION

Florida Driver License or, if you do not drive, a Florida Identification Card or a declaration of

domicile recorded prior to January 1, 2018;

Florida Auto Registration, for vehicles owned or leased by you, or registered to your business;

Brevard County Voter Registration Card, if you are registered to vote.

Social Security Number (preferably your card or some other document with your number) Social

Security Number is required for the spouse of each applicant even if said spouse has no ownership

interest;

If not a U.S. citizen, a Resident Alien Card ("Green Card');

If property is in trust, a copy of the complete trust agreement or a recorded Memorandum of Trust;

A copy of your recorded deed or tax bill;

If dwelling is a manufactured home, bring registration or title to manufactured home.

If the taxpayer owns property in any other State or Country, a letter from the appropriate governmental

department verifying that the taxpayer does not receive benefits there that are based on permanent

residency..

Under Florida law, failure to file homestead exemption by March 1, 2018 constitutes a waiver of the exemption

privilege for the year.

If you purchased a new home after January 1, 2017 and you are a resident of Brevard County, you may qualify for a

savings on your 2018 tax bill by pre-filing for homestead exemption after March 1, 2017.

OTHER TYPES OF EXEMPTIONS ARE AVAILABLE

Please complete, sign and date your Homestead Application, and mail to:

Brevard County Property Appraiser

Attn: Homestead Exemptions

P.O. Box 429

Titusville, Florida 32781

FOR YOUR PROTECTION

RETURN RECEIPT SERVICE FROM THE POST OFFICE IS HIGHLY RECOMMENDED,

and

To obtain an acknowledged copy of your original application, please include a stamped self-addressed

envelope. If you do not receive an acknowledged copy of your original application within a reasonable

amount of time, you should contact our office to determine if your original application was received.

Please contact the Brevard County Property Appraiser’s Office at :

(321) 264-6700 if you have any questions.

1

1 2

2 3

3