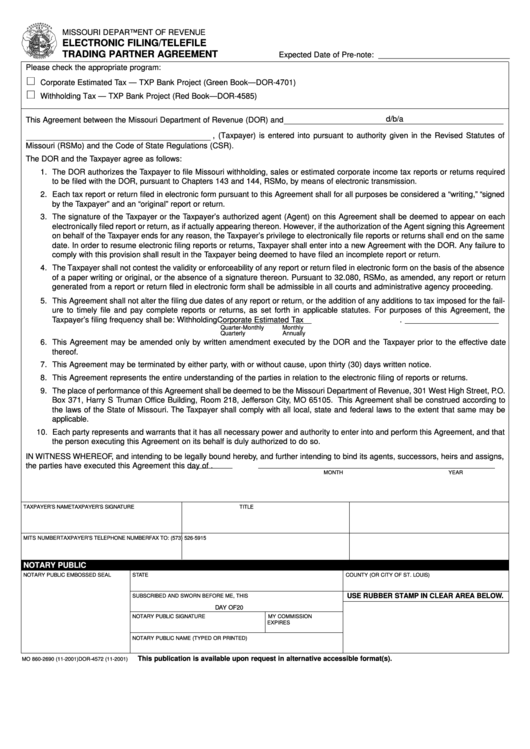

Form Mo 860-2690-Electronic Filing/telefile Trading Partner Agreement

ADVERTISEMENT

MISSOURI DEPARTMENT OF REVENUE

ELECTRONIC FILING/TELEFILE

TRADING PARTNER AGREEMENT

Expected Date of Pre-note: ______________________________

Please check the appropriate program:

Corporate Estimated Tax — TXP Bank Project (Green Book—DOR-4701)

Withholding Tax — TXP Bank Project (Red Book—DOR-4585)

d/b/a

This Agreement between the Missouri Department of Revenue (DOR) and

, (Taxpayer) is entered into pursuant to authority given in the Revised Statutes of

Missouri (RSMo) and the Code of State Regulations (CSR).

The DOR and the Taxpayer agree as follows:

1. The DOR authorizes the Taxpayer to file Missouri withholding, sales or estimated corporate income tax reports or returns required

to be filed with the DOR, pursuant to Chapters 143 and 144, RSMo, by means of electronic transmission.

2. Each tax report or return filed in electronic form pursuant to this Agreement shall for all purposes be considered a “writing,” “signed

by the Taxpayer” and an “original” report or return.

3. The signature of the Taxpayer or the Taxpayer’s authorized agent (Agent) on this Agreement shall be deemed to appear on each

electronically filed report or return, as if actually appearing thereon. However, if the authorization of the Agent signing this Agreement

on behalf of the Taxpayer ends for any reason, the Taxpayer’s privilege to electronically file reports or returns shall end on the same

date. In order to resume electronic filing reports or returns, Taxpayer shall enter into a new Agreement with the DOR. Any failure to

comply with this provision shall result in the Taxpayer being deemed to have filed an incomplete report or return.

4. The Taxpayer shall not contest the validity or enforceability of any report or return filed in electronic form on the basis of the absence

of a paper writing or original, or the absence of a signature thereon. Pursuant to 32.080, RSMo, as amended, any report or return

generated from a report or return filed in electronic form shall be admissible in all courts and administrative agency proceeding.

5. This Agreement shall not alter the filing due dates of any report or return, or the addition of any additions to tax imposed for the fail-

ure to timely file and pay complete reports or returns, as set forth in applicable statutes. For purposes of this Agreement, the

Taxpayer’s filing frequency shall be: Withholding

Corporate Estimated Tax

.

Quarter-Monthly

Monthly

Quarterly

Annually

6. This Agreement may be amended only by written amendment executed by the DOR and the Taxpayer prior to the effective date

thereof.

7. This Agreement may be terminated by either party, with or without cause, upon thirty (30) days written notice.

8. This Agreement represents the entire understanding of the parties in relation to the electronic filing of reports or returns.

9. The place of performance of this Agreement shall be deemed to be the Missouri Department of Revenue, 301 West High Street, P.O.

Box 371, Harry S Truman Office Building, Room 218, Jefferson City, MO 65105. This Agreement shall be construed according to

the laws of the State of Missouri. The Taxpayer shall comply with all local, state and federal laws to the extent that same may be

applicable.

10. Each party represents and warrants that it has all necessary power and authority to enter into and perform this Agreement, and that

the person executing this Agreement on its behalf is duly authorized to do so.

IN WITNESS WHEREOF, and intending to be legally bound hereby, and further intending to bind its agents, successors, heirs and assigns,

the parties have executed this Agreement this

day of

.

MONTH

YEAR

TAXPAYER’S NAME

TAXPAYER’S SIGNATURE

TITLE

MITS NUMBER

TAXPAYER’S TELEPHONE NUMBER

FAX TO: (573) 526-5915

NOTARY PUBLIC

NOTARY PUBLIC EMBOSSED SEAL

STATE

COUNTY (OR CITY OF ST. LOUIS)

USE RUBBER STAMP IN CLEAR AREA BELOW.

SUBSCRIBED AND SWORN BEFORE ME, THIS

DAY OF

20

NOTARY PUBLIC SIGNATURE

MY COMMISSION

EXPIRES

NOTARY PUBLIC NAME (TYPED OR PRINTED)

This publication is available upon request in alternative accessible format(s).

MO 860-2690 (11-2001)

DOR-4572 (11-2001)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1