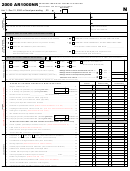

FORM N-15 (REV. 2004)

PAGE 2

37 Hawaii adjusted gross income from line 36, Column B.........................................................................................

37

00

.

38 Ratio of Hawaii AGI to Total AGI. Divide line 36, Column B, by line 36, Column A

38l

(Compute to 3 decimal places and round to 2 decimal places)

£

l and see Instructions.

CAUTION: If you can be claimed as a dependent on another person’s return, check here

39 If you do not itemize deductions, enter zero on line 39g and go to line 40a. Otherwise go to page 19 of the

Instructions and enter your Hawaii itemized deductions here.

39a Medical and dental expenses (from Worksheet NR-1 or PY-1) ....................................

39al

00

00

39b Taxes (from Worksheet NR-2 or PY-2) .......................................................................

39bl

00

39c Interest expense (from Worksheet NR-3 or PY-3) .......................................................

39cl

39d Contributions (from Worksheet NR-4 or PY-4) ............................................................

39dl

00

00

39e Casualty and theft losses (from Worksheet NR-5 or PY-5) ..........................................

39el

39f Miscellaneous deductions (from Worksheet NR-6 or PY-6) .........................................

39fl

00

39g If line 37 is more than $100,000 ($50,000 for married filing separately), see the worksheet on page 39 of the

Instructions. If not, add lines 39a through 39f. Enter total here and go to line 41 ......Total Itemized Deductions

39g

00

[

]

40a If you checked filing status box:

1, enter $1,500

3, enter $950

00

2 or 5, enter $1,900

4, enter $1,650

.....

40a

40b Multiply line 40a by the ratio on line 38 .................................................................Prorated Standard Deduction

40bl

00

00

41 Line 37 minus line 39g or 40b, whichever applies. (This line MUST be filled in) ........................................................

41l

42a Multiply $1,040 by the total number of exemptions claimed on line 6e. If you and/or your spouse are blind,

£

£

deaf, or disabled, check applicable box(es) l

Yourself l

Spouse, and see page 24 of the Instructions 42a

00

42b Multiply line 42a by the ratio on line 38 ............................................................................Prorated Exemption(s)

42bl

00

43 Taxable Income. Line 41 minus line 42b (but not less than zero) .............................................Taxable Income

43l

00

£

£

£

£

£

44 Tax. Check if from

Tax Table;

Tax Rate Schedule;

Form N-168;

Form N-615; or

Capital Gains Tax Worksheet on

page 39 of the Instructions. Net capital gain from line 14 of Capital Gains Tax Worksheet l

£

(l

Include separate tax from Forms N-2, N-103, N-152, N-312, N-318, N-405, N-586, or N-814) .............Tax

44l

00

45 Total nonrefundable tax credits (attach Schedule CR) ...............................................................................................

45

00

46 Line 44 minus line 45 (but not less than zero) ..........................................................................................Balance

46

00

00

47 Hawaii State Income tax withheld, and tax withheld on Forms N-2 or N-4 ....................

47l

00

48 2004 estimated tax payments on Forms N-1 _________ ; N-288A _________ ..........

48l

49 Amount of estimated tax applied from 2003 return ......................................................

49l

00

00

50 Amount paid with extension(s) ...................................................................................

50l

51 Low-Income Refundable Tax Credit (attach Schedule X) DHS, etc. exemptions l

51l

00

00

52 Credit for Low-Income Household Renters (attach Schedule X)...................................

52l

00

53 Credit for Child and Dependent Care Expenses (attach Schedule X) ...........................

53l

54 Credit for Child Passenger Restraint System(s) (attach a copy of the invoice) ......................

54l

00

00

55 Total refundable tax credits from Schedule CR (attach Schedule CR)..........................

55

56 Add lines 47 through 55............................................................................................Total Payments and Credits

56l

00

00

57 If line 56 is larger than line 46, enter the amount OVERPAID (line 56 minus line 46) ................................................

57l

00

58 Amount of line 57 to be applied to your 2005 ESTIMATED TAX.................................

58l

59 Line 57 minus line 58 ..................................................................................................................................................

59l

00

60 Contribution to Hawaii School-Level Minor Repairs and Maintenance Special Fund. (See Instructions)

£

£

l

l

Yourself

Spouse. (Enter $2 if one box is checked, or $4 if both boxes are checked) ....

60

00

61 Contribution to Hawaii Public Libraries Special Fund. (See Instructions)

£

£

l

l

Yourself

Spouse. (Enter $2 if one box is checked, or $4 if both boxes are checked) ....

61

00

62 Add lines 60 and 61 ....................................................................................................................................................

62

00

63 Amount to be REFUNDED TO YOU (line 59 minus line 62) If late filing, see page 29 of Instructions .......................

63

00

64 AMOUNT YOU OWE (line 46 minus line 56). Send Form N-200V with your payment...............................................

64l

00

65 Estimated tax penalty. (See page 30 of Instructions.) Do not include this amount in

£

line 57 or 64. Check box if Form N-210 is attached

...........................................

65l

00

£

U

66 If you would like us to mail you a packet of forms for next year’s filing, please check this box ...................................

l

67 Proceeds from the sale of a qualified high technology business’ NOL l $

If designating another person to discuss this return with the Hawaii Department of Taxation, complete the following. This is not a full power of attorney.

See page 30 of the Instructions.

Designee’s name

Phone no.

Identification number

DECLARATION — I declare, under the penalties set forth in section 231-36, HRS, that this return (including accompanying schedules or statements) has been examined by me

and, to the best of my knowledge and belief, is a true, correct, and complete return, made in good faith, for the taxable year stated, pursuant to the Hawaii Income Tax Law, Chap -

ter 235, HRS.

Your signature

Date

Spouse’s signature (if filing jointly, BOTH must sign)

Date

Preparer’s Signature

£

Preparer’s identification number

Check if

Paid

and date

self-employed

Print Preparer’s Name

Preparer’s

Firm’s name (or yours

Federal E.I. No.

Information

if self-employed),

Address, and ZIP Code

Phone no.

Form N-15

1

1 2

2