Form 1306 - Local Earned Income Tax Return

ADVERTISEMENT

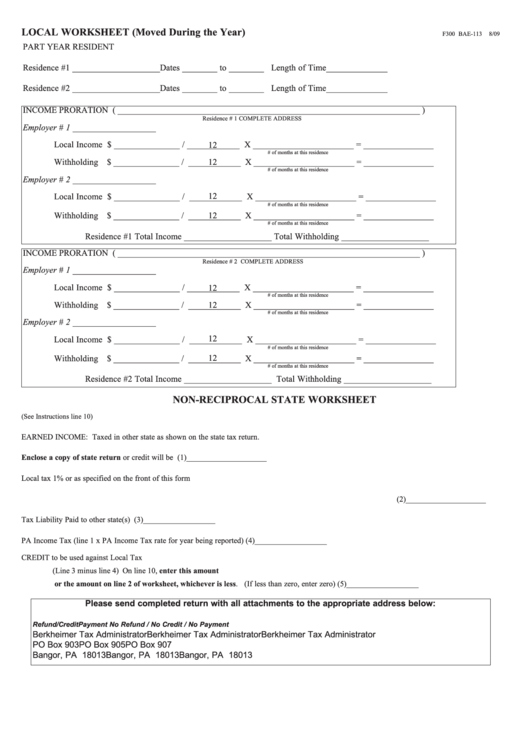

LOCAL WORKSHEET (Moved During the Year)

F300 BAE-113

8/09

PART YEAR RESIDENT

Residence #1 ____________________

Dates ________ to ________ Length of Time______________

Residence #2 ____________________

Dates ________ to ________ Length of Time______________

INCOME PRORATION ( _____________________________________________________________________ )

Residence # 1 COMPLETE ADDRESS

Employer # 1 ___________________

Local Income $ _______________ / ____________ X _______________________ = ________________

12

# of months at this residence

Withholding $ _______________ / ____________ X _______________________ = ________________

12

# of months at this residence

Employer # 2 ___________________

12

Local Income $ _______________ / ____________ X _______________________ = ________________

# of months at this residence

12

Withholding $ _______________ / ____________ X _______________________ = ________________

# of months at this residence

Residence #1

Total Income ____________________ Total Withholding ____________________

INCOME PRORATION ( _____________________________________________________________________ )

Residence # 2 COMPLETE ADDRESS

Employer # 1 ___________________

Local Income $ _______________ / ____________ X _______________________ = ________________

12

# of months at this residence

Withholding $ _______________ / ____________ X _______________________ = ________________

12

# of months at this residence

Employer # 2 ___________________

12

Local Income $ _______________ / ____________ X _______________________ = ________________

# of months at this residence

12

Withholding $ _______________ / ____________ X _______________________ = ________________

# of months at this residence

Residence #2

Total Income ____________________ Total Withholding ____________________

NON-RECIPROCAL STATE WORKSHEET

(See Instructions line 10)

EARNED INCOME: Taxed in other state as shown on the state tax return.

Enclose a copy of state return or credit will be disallowed ..........................................................................................

(1) ____________________

Local tax 1% or as specified on the front of this form ..................................................................................................

X ____________________

(2) ____________________

Tax Liability Paid to other state(s) ......................................................................................

(3) __________________

PA Income Tax (line 1 x PA Income Tax rate for year being reported) ..............................

(4) __________________

CREDIT to be used against Local Tax

(Line 3 minus line 4) On line 10, enter this amount

or the amount on line 2 of worksheet, whichever is less. (If less than zero, enter zero) ............................

(5) __________________

Please send completed return with all attachments to the appropriate address below:

Refund/Credit

Payment

No Refund / No Credit / No Payment

Berkheimer Tax Administrator

Berkheimer Tax Administrator

Berkheimer Tax Administrator

PO Box 903

PO Box 905

PO Box 907

Bangor, PA 18013

Bangor, PA 18013

Bangor, PA 18013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5