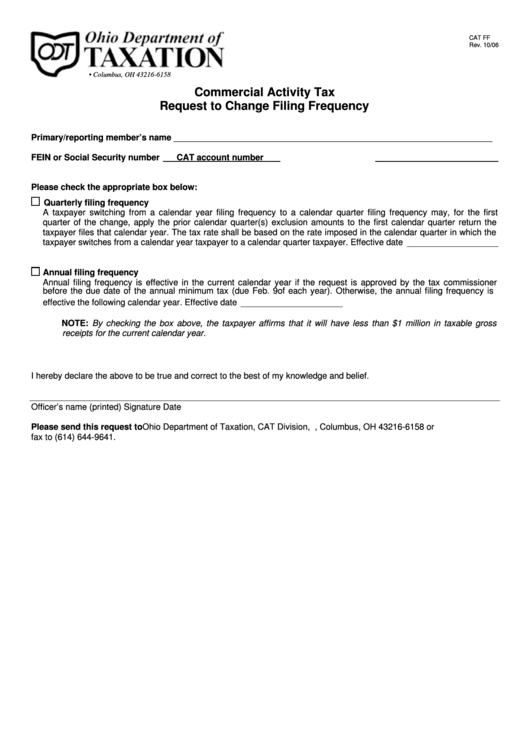

Commercial Activity Tax Request To Change Filing Frequency - Ohio Department Of Taxation

ADVERTISEMENT

CAT FF

Rev. 10/06

P.O. Box 16158 • Columbus, OH 43216-6158

Commercial Activity Tax

Request to Change Filing Frequency

Primary/reporting member’s name ___________________________________________________________________

FEIN or Social Security number

CAT account number

Please check the appropriate box below:

Quarterly filing frequency

A taxpayer switching from a calendar year filing frequency to a calendar quarter filing frequency may, for the first

quarter of the change, apply the prior calendar quarter(s) exclusion amounts to the first calendar quarter return the

taxpayer files that calendar year. The tax rate shall be based on the rate imposed in the calendar quarter in which the

taxpayer switches from a calendar year taxpayer to a calendar quarter taxpayer. Effective date

Annual filing frequency

Annual filing frequency is effective in the current calendar year if the request is approved by the tax commissioner

before the due date of the annual minimum tax (due Feb. 9 of each year). Otherwise, the annual filing frequency is

effective the following calendar year. Effective date

NOTE: By checking the box above, the taxpayer affirms that it will have less than $1 million in taxable gross

receipts for the current calendar year.

I hereby declare the above to be true and correct to the best of my knowledge and belief.

Officer’s name (printed)

Signature

Date

Please send this request to Ohio Department of Taxation, CAT Division, P.O. Box 16158, Columbus, OH 43216-6158 or

fax to (614) 644-9641.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1