Employer'S Quarterly Wage And Contribution C-101 Report Item-By-Item Instructions - Vermont Department Of Labor Page 5

ADVERTISEMENT

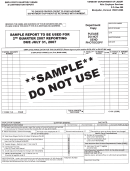

INSTRUCTIONS FOR FORM C-147

This additional report form can be used when an employer has more employees than the original Quarterly Wage

& Contribution Report (Form C-101) form can accommodate.

WHO MUST FILE

Every employer who is subject to the Vermont Unemployment Compensation Law (Title 21, Chapter 17, VSA).

Inquiries on these instructions can be made by calling 802-828-4344.

DUE DATES

The completed report forms should be returned with the Quarterly Wage & Contribution Report (Form C-101) and

must be returned or postmarked on or before the due date shown on the face of the Quarterly Wage &

Contribution Report. Complete each page by entering the Employer's Vermont Unemployment Account Number,

the Quarter Ending Date, the Employer Name and the following information for each employee:

Enter employee's Social Security Number.

ITEM 1

Enter the employee's last name, full first name, and middle initial.

ITEM 2

Enter the total gross wages paid the employee during the quarter.

ITEM 3

Enter H for an Hourly worker or S for a Salaried worker. If S, skip to Item 6.

ITEM 4

Enter hourly rate of pay. If worker receives multiple rates, enter the predominant rate.

ITEM 5

(For example, a worker works 15 hours at $7.00 per hour and 25 hours at $8.00; enter $8.00.

Enter F for Female or M for Male

ITEM 6

Enter page number and total gross wages paid to all employees for the quarter for each page. Total

ITEM 7

of ALL pages should agree with the amount on ITEM 9 on the Employer's Quarterly Wage &

Contribution Report.

ADDITIONAL FORMS

To request an additional supply of reporting forms, contact the department at 802-828-4344. When submitting

additional information without a department form, paper must be 8-1/2" x 11" with print NO LESS THAN 1/8"

HIGH, SPACED VERTICALLY NO MORE THAN 3 OR 4 LINES PER INCH, TYPED OR BLOCK PRINTED IN

DARK BLUE OR BLACK INK ONLY. Each sheet must be headed with your employer number, quarter ending

date and employer name. Your format must include the six columns in this order - Social Security number, Name

(Last, First, Middle Initial), Quarterly Gross Wages Paid, Hourly or Salaried worker indicator, Hourly Rate and

Gender. If using a computer printout, any additional columns MUST be crossed out. Make only one entry per

employee. Negative wages are not accepted. Each page must end with the page number and a subtotal of the

wages on that page. Additional report pages need not be individually signed and dated, but they must be

returned with a properly signed Quarterly Wage & Contribution Report (Form C-101).

MAGNETIC MEDIA

Information on submitting wage information via magnetic media can be found on our web site at

under the "Unemployment Insurance & Wages", "Forms and Publications" links.

Questions about the specifications can be answered by calling 802-828-4253. Before sending live data, an

authorized request must be completed and sent in. This form is part of the specification information on the web

site.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5