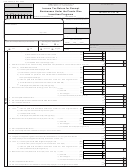

Form 480.30(Ii) - Income Tax Return For Exempt Business Under The Puerto Rico Incentives Programs Page 2

ADVERTISEMENT

Form 480.30(II) Rev. 05.02

Incentives - Page 2

Part II

Applicable Tax Exemption Acts

Indicate under which of the following act or acts the exempt business operates:

q

Act No. 57 of June 13, 1963

Case Number: ___________________________________

q

Act No. 168 of June 30, 1968

Case Number: ___________________________________

q

Act No. 26 of June 2, 1978

Case Number: ___________________________________

q

Act No. 52 of June 2, 1983

Case Number: ___________________________________

q

Act No. 8 of January 24, 1987

Case Number: ___________________________________

q

Act No. 148 of August 8, 1988

Case Number: ___________________________________

q

Act No. 78 of September 10, 1993

Case Number: ___________________________________

q

Act No. 75 of July 5, 1995

Case Number: ___________________________________

q

Act No. 225 of December 1, 1995

Case Number: ___________________________________

q

Act No. 14 of March 15, 1996

Case Number: ___________________________________

q

Act No. 135 of December 2, 1997

Case Number: ___________________________________

q

Act No. 362 of December 24, 1999

Case Number: ___________________________________

q

Case Number: ___________________________________

Act No. 178 of August 18, 2000

If you check Act No. 26 of 1978 or Act No. 8 of 1987, complete Part III, if applicable.

Part III

Conditions that Exonerate from the Prepayment of Tollgate Tax

Each exempt business under Act 26 of 1978 or Act 8 of 1987 is generally subject to the prepayment of tollgate tax.

q

q

Is the exempt business subject to the prepayment?

Yes

No

f the exempt business is not subject to the prepayment of tollgate tax, indicate which of the following conditions exonerates

I

such payment:

q

The exempt business elected the optional tax under Section 3A of Act 8 of 1987.

q

50% or more of the outstanding stocks are owned by individuals.

q

Its annual industrial development income is less than $1,000,000.

q

Its industrial development income is exempt pursuant to the provisions of Sections 2(e)(4), 2(e)(11) or 3(m) of Act 8 of 1987.

q

Its industrial development income is exempt pursuant to Sections 2(e)(5), 2(e)(12), 2(e)(20), 2(e)(26) or 3(n) of Act 26 of 1978.

q

The exempt business is covered under Section 4(a)(8) of Act 8 of 1987 (See instructions).

If any portion of the Exempt Business Industrial Development Income is not exempt from the prepayment of Tollgate Tax,

continue with Part IV.

Part IV

Computation of Prepayment of Tollgate Tax

1.

Net operating income for the year:

00

a)

Schedule M Incentives, Part I, line 1.......................................................

(1a)

00

b)

Schedule N Incentives, Part I, line 1.............................................................

(1b)

0 0

c)

Total net operating income for the year ....................................................................................

(1c)

2.

Adjustments:

00

a)

Interest income from certain 2(j) investments (See instructions) ................

(2a)

00

b)

Other adjustments (See instructions) .....................................................

(2b)

0 0

c)

Total adjustments (Add lines 2(a) and 2(b)) .............................................................................

(2c)

3.

Industrial development income (IDI) after adjustments (If line 1(c) is larger than line 2(c),

0 0

enter the difference here. Otherwise, do not continue with this form) .....................................................

(3)

4.

Less tax determined on industrial development income:

00

a)

Total tax (Schedule K Incentives, Part I, Column B, line 15) .....................

(4a)

00

b)

Special surtax (Part I, line 8) .................................................................

(4b)

00

c)

Other taxes

(See instructions) ..............................................................

(4c)

0 0

d)

Total taxes (Add lines 4(a) through

4(c)) ................................................................................

(4d)

0 0

5.

Net IDI available for distribution (Subtract line 4(d) from line 3).................................................................

(5)

(6)

0 0

6.

Determination of prepayment of tollgate tax (5% or

%

of line 5) (See instructions) ................

7.

00

Dividends declared from current earnings ...................................................

(7)

0 0

8.

Prepayment of tollgate tax attributable to current earnings (Multiply line 7 by 5% or

) ...........

%

(8)

0 0

9.

Prepayment of tollgate tax before credits (Subtract line 8 from line 6) .......................................................

(9)

10.

Less credits:

00

a)

Special credit granted (Do not exceed 50% of line 9).........................

(10a)

00

b)

Other credits (See instructions)............................................................

(10b)

0 0

c)

Total (Add lines 10(a) and 10(b)) ............................................................................................

(10c)

11.

Total prepayment of tollgate tax liability (Subtract line 10(c) from line 9. Enter in Part I, line 13).............

(11)

0 0

Conservation Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4