Instructions For Form 500dm

ADVERTISEMENT

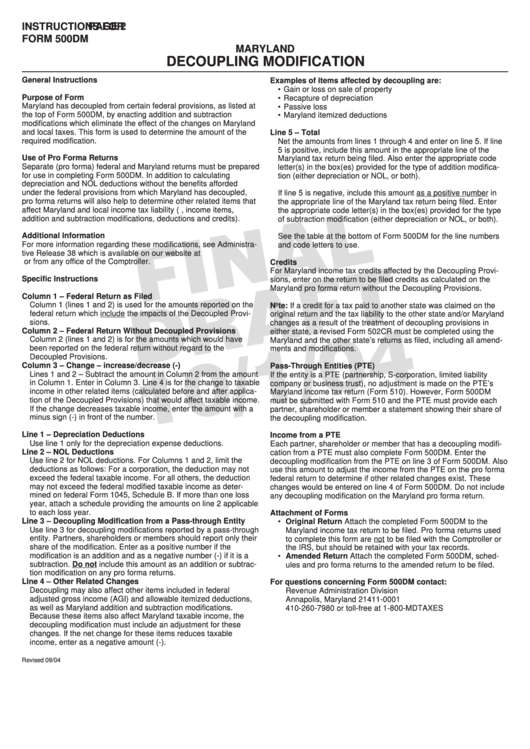

INSTRUCTIONS FOR

PAGE 2

FORM 500DM

MARYLAND

DECOUPLING MODIFICATION

General Instructions

Examples of items affected by decoupling are:

• Gain or loss on sale of property

Purpose of Form

• Recapture of depreciation

Maryland has decoupled from certain federal provisions, as listed at

• Passive loss

the top of Form 500DM, by enacting addition and subtraction

• Maryland itemized deductions

modifications which eliminate the effect of the changes on Maryland

and local taxes. This form is used to determine the amount of the

Line 5 – Total

required modification.

Net the amounts from lines 1 through 4 and enter on line 5. If line

5 is positive, include this amount in the appropriate line of the

Use of Pro Forma Returns

Maryland tax return being filed. Also enter the appropriate code

Separate (pro forma) federal and Maryland returns must be prepared

letter(s) in the box(es) provided for the type of addition modifica-

for use in completing Form 500DM. In addition to calculating

tion (either depreciation or NOL, or both).

depreciation and NOL deductions without the benefits afforded

under the federal provisions from which Maryland has decoupled,

If line 5 is negative, include this amount as a positive number in

pro forma returns will also help to determine other related items that

the appropriate line of the Maryland tax return being filed. Enter

affect Maryland and local income tax liability (e.g., income items,

the appropriate code letter(s) in the box(es) provided for the type

addition and subtraction modifications, deductions and credits).

of subtraction modification (either depreciation or NOL, or both).

Additional Information

See the table at the bottom of Form 500DM for the line numbers

For more information regarding these modifications, see Administra-

and code letters to use.

tive Release 38 which is available on our website at

or from any office of the Comptroller.

Credits

For Maryland income tax credits affected by the Decoupling Provi-

Specific Instructions

sions, enter on the return to be filed credits as calculated on the

Maryland pro forma return without the Decoupling Provisions.

Column 1 – Federal Return as Filed

Column 1 (lines 1 and 2) is used for the amounts reported on the

Note: If a credit for a tax paid to another state was claimed on the

federal return which include the impacts of the Decoupled Provi-

original return and the tax liability to the other state and/or Maryland

sions.

changes as a result of the treatment of decoupling provisions in

Column 2 – Federal Return Without Decoupled Provisions

either state, a revised Form 502CR must be completed using the

Column 2 (lines 1 and 2) is for the amounts which would have

Maryland and the other state’s returns as filed, including all amend-

been reported on the federal return without regard to the

ments and modifications.

Decoupled Provisions.

Column 3 – Change – increase/decrease (-)

Pass-Through Entities (PTE)

Lines 1 and 2 – Subtract the amount in Column 2 from the amount

If the entity is a PTE (partnership, S-corporation, limited liability

in Column 1. Enter in Column 3. Line 4 is for the change to taxable

company or business trust), no adjustment is made on the PTE’s

income in other related items (calculated before and after applica-

Maryland income tax return (Form 510). However, Form 500DM

tion of the Decoupled Provisions) that would affect taxable income.

must be submitted with Form 510 and the PTE must provide each

If the change decreases taxable income, enter the amount with a

partner, shareholder or member a statement showing their share of

minus sign (-) in front of the number.

the decoupling modification.

Line 1 – Depreciation Deductions

Income from a PTE

Use line 1 only for the depreciation expense deductions.

Each partner, shareholder or member that has a decoupling modifi-

Line 2 – NOL Deductions

cation from a PTE must also complete Form 500DM. Enter the

Use line 2 for NOL deductions. For Columns 1 and 2, limit the

decoupling modification from the PTE on line 3 of Form 500DM. Also

deductions as follows: For a corporation, the deduction may not

use this amount to adjust the income from the PTE on the pro forma

exceed the federal taxable income. For all others, the deduction

federal return to determine if other related changes exist. These

may not exceed the federal modified taxable income as deter-

changes would be entered on line 4 of Form 500DM. Do not include

mined on federal Form 1045, Schedule B. If more than one loss

any decoupling modification on the Maryland pro forma return.

year, attach a schedule providing the amounts on line 2 applicable

to each loss year.

Attachment of Forms

Line 3 – Decoupling Modification from a Pass-through Entity

• Original Return Attach the completed Form 500DM to the

Use line 3 for decoupling modifications reported by a pass-through

Maryland income tax return to be filed. Pro forma returns used

entity. Partners, shareholders or members should report only their

to complete this form are not to be filed with the Comptroller or

share of the modification. Enter as a positive number if the

the IRS, but should be retained with your tax records.

modification is an addition and as a negative number (-) if it is a

• Amended Return Attach the completed Form 500DM, sched-

subtraction. Do not include this amount as an addition or subtrac-

ules and pro forma returns to the amended return to be filed.

tion modification on any pro forma returns.

Line 4 – Other Related Changes

For questions concerning Form 500DM contact:

Decoupling may also affect other items included in federal

Revenue Administration Division

adjusted gross income (AGI) and allowable itemized deductions,

Annapolis, Maryland 21411-0001

as well as Maryland addition and subtraction modifications.

410-260-7980 or toll-free at 1-800-MDTAXES

Because these items also affect Maryland taxable income, the

decoupling modification must include an adjustment for these

changes. If the net change for these items reduces taxable

income, enter as a negative amount (-).

Revised 09/04

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1