Instructions For Form St-102-A New York State And Local Annual Sales And Use Tax Return For A Single Jurisdiction Page 6

ADVERTISEMENT

Page 6 of 6 ST‑102‑A‑I (2/06)

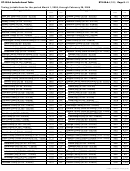

ST‑102‑A Jurisdictional Table

Taxing jurisdiction

Taxing jurisdiction

Jurisdiction

Tax

Jurisdiction

Tax

code

rate

code

rate

Rensselaer County (3/1/05 - 5/31/05)

3871

83%

Ulster County (3/1/05 - 5/31/05)

5101

83%

Rensselaer County (6/1/05 - 2/28/06)

3881

8%

Ulster County (6/1/05 - 2/28/06)

5111

8%

Rockland County (3/1/05 - 5/31/05)

3901

8c%

Warren County (outside the following) (3/1/05 - 5/31/05)

5291

73%

Rockland County (6/1/05 - 2/28/06)

3911

8%

Warren County (outside the following) (6/1/05 - 2/28/06)

5281

7%

St. Lawrence County (3/1/05 - 5/31/05)

4081

73%

Glens Falls (city) (3/1/05 - 5/31/05)

5201

73%

St. Lawrence County (6/1/05 - 2/28/06)

4091

7%

Glens Falls (city) (6/1/05 - 2/28/06)

5211

7%

Saratoga County (outside the following) (3/1/05 - 5/31/05)

4101

73%

Washington County (3/1/05 - 5/31/05)

5301

73%

Saratoga County (outside the following) (6/1/05 - 2/28/06)

4111

7%

Washington County (6/1/05 - 2/28/06)

5311

7%

Saratoga Springs (city) (3/1/05 - 5/31/05)

4121

73%

Wayne County (3/1/05 - 5/31/05)

5411

83%

Saratoga Springs (city) (6/1/05 - 2/28/06)

4131

7%

Wayne County (6/1/05 - 2/28/06)

5421

8%

Schenectady County (3/1/05 - 5/31/05)

4231

83%

Westchester County (outside the following) (3/1/05 - 5/31/05)

5591

72%

Schenectady County (6/1/05 - 2/28/06)

4241

8%

Westchester County (outside the following) (6/1/05 - 2/28/06)

5581

7d%

Schoharie County (3/1/05 - 5/31/05)

4311

83%

Mount Vernon (city) (3/1/05 - 5/31/05)

5511

82%

Schoharie County (6/1/05 - 2/28/06)

4321

8%

Mount Vernon (city) (6/1/05 - 2/28/06)

5521

8d%

Schuyler County (3/1/05 - 5/31/05)

4401

83%

New Rochelle (city) (3/1/05 - 5/31/05)

6851

82%

Schuyler County (6/1/05 - 2/28/06)

4411

8%

New Rochelle (city) (6/1/05 - 2/28/06)

6861

8d%

Seneca County (3/1/05 - 5/31/05)

4501

83%

White Plains (city) (3/1/05 - 5/31/05)

5551

8%

Seneca County (6/1/05 - 2/28/06)

4511

8%

White Plains (city) (6/1/05 - 2/28/06)

5561

7f%

Steuben County (outside the following) (3/1/05 - 5/31/05)

4681

83%

Yonkers (city) (3/1/05 - 5/31/05)

6501

82%

Steuben County (outside the following) (6/1/05 - 2/28/06)

4691

8%

Yonkers (city) (6/1/05 - 2/28/06)

6511

8d%

Corning (city) (3/1/05 - 5/31/05)

4601

83%

Wyoming County (3/1/05 - 5/31/05)

5601

83%

Corning (city) (6/1/05 - 2/28/06)

4611

8%

Wyoming County (6/1/05 - 2/28/06)

5621

8%

Hornell (city) (3/1/05 - 5/31/05)

4631

83%

Yates County (3/1/05 - 5/31/05)

5711

83%

Hornell (city) (6/1/05 - 2/28/06)

4641

8%

Yates County (6/1/05 - 2/28/06)

5721

8%

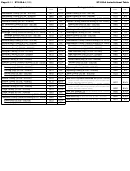

Suffolk County (3/1/05 - 5/31/05)

4701

8:%

New York City/State combined tax (3/1/05 - 5/31/05)

[includes counties of Bronx, Kings (Brooklyn), New York (Manhattan),

Suffolk County (6/1/05 - 2/28/06)

4711

8e%

8011

8e%

Queens, and Richmond (Staten Island)]

Sullivan County (3/1/05 - 5/31/05)

4801

7:%

New York City/State combined tax (6/1/05 - 2/28/06)

Sullivan County (6/1/05 - 2/28/06)

4811

72%

[includes counties of Bronx, Kings (Brooklyn), New York (Manhattan),

8051

8d%

Queens, and Richmond (Staten Island)]

Tioga County (3/1/05 - 5/31/05)

4911

83%

New York State/MCTD

8041

42%

(fuel and utilities) (3/1/05 - 5/31/05)

Tioga County (6/1/05 - 2/28/06)

4921

8%

New York State/MCTD

8061

4d%

(fuel and utilities) (6/1/05 - 2/28/06)

Tompkins County (outside the following) (3/1/05 - 5/31/05)

5091

83%

New York City —

8021

4c%

local tax only (3/1/05 - 5/31/05)

Tompkins County (outside the following) (6/1/05 - 2/28/06)

5081

8%

New York City —

8071

4%

local tax only (6/1/05 - 2/28/06)

Ithaca (city) (3/1/05 - 5/31/05)

5011

83%

Ithaca (city) (6/1/05 - 2/28/06)

5021

8%

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11