Instructions For Form St-102-A New York State And Local Annual Sales And Use Tax Return For A Single Jurisdiction Page 7

ADVERTISEMENT

ST-102.1-A

New York State Department of Taxation and Finance

(2/06)

For the periods:

August 30, 2005, through September 5, 2005

January 30, 2006, through February 5, 2006

A06

Sales and Use Tax Exemption on Clothing and Footwear

Use this form only to find your jurisdiction code and rate of tax for the periods August 30, 2005, through

September 5, 2005, and January 30, 2006, through February 5, 2006.

The following items are not eligible for exemption:

General

• Clothing and footwear that sold for $110 or more per item.

Use Form ST-102.1-A if you file Form ST-102-A, New York

• Costumes or rented formal wear.

State and Local Annual Sales and Use Tax Return for a Single

• Items made from pearls, precious or semi-precious stones,

Jurisdiction, and you sold any clothing or footwear eligible for

jewels, or metals, or imitations thereof, that are used to make or

exemption from the state sales and use tax during the periods

repair clothing eligible for exemption.

Tuesday, August 30, 2005, through Monday, September 5,

• Athletic equipment.

2005, and Monday, January 30, 2006, through Sunday,

February 5, 2006. Use Form ST-102.1-A to find your jurisdiction

• Protective devices, such as motorcycle helmets.

code and rate of tax.

Local taxing jurisdictions in the state also may elect to exempt

sales of eligible clothing and footwear from their local tax rate.

Clothing and footwear eligible for exemption means clothing and

See Part 2 on page 2 for a listing of the jurisdictions and codes for

footwear for humans that sold for less than $110 per item and was

reporting sales of eligible clothing in those jurisdictions that enacted

exempt from the 4% state sales and use tax.

exemptions.

Items eligible for exemption include athletic clothing, as well as

If a local jurisdiction does not elect to exempt these sales, tax will

fabric, thread, yarn, buttons, snaps, hooks, zippers, and other items

be charged at the local rate only.

used to make or repair clothing, that became part of the clothing.

Sales of clothing and footwear not eligible for exemption are

subject to both state and local taxes and must be reported for the

appropriate jurisdiction on Form ST-102-A.

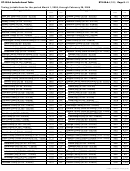

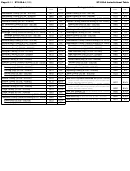

Part 1 — For jurisdictions that impose the local tax

For sales made in jurisdictions that charge the local tax, use the chart below to find the jurisdiction code and rate of tax that is due on sales

of eligible clothing and footwear that sold for less than $110. If you made sales of clothing and footwear that sold for $110 or more in any of

these localities, report these sales at the full state and local rate for the appropriate jurisdiction on Form ST-102-A.

Taxing jurisdiction

Taxing jurisdiction

Jurisdiction

Tax

Jurisdiction

Tax

code

rate

code

rate

Lewis County

LE H2313

3¾%

Putnam County (8/30/05 - 8/31/05)

PU H3705

3

/

%

3

8

Nassau County

NA H8277

4

/

%

5

Putnam County (9/1/05 - 9/5/05 and 1/30/06 - 2/5/06)

PU H3706

3

/

%

7

8

8

Oneida County — outside the following, see Part 2

/

Westchester County (outside the following)

WE H5545

3

3

%

8

Rome (city) — For sales made in the city of Rome, see Part 2.

/

Mount Vernon (city)

MO H5547

4

3

%

8

Sherrill (city) — For sales made in the city of Sherrill, see Part 2.

/

New Rochelle (city)

NE H6899

4

3

%

8

Utica (city)

UT H3080

1½%

White Plains (city)

WH H5548

3

7

/

%

8

Orange County

OR H1355

4

1

/

%

Yonkers (city)

YO H6570

4

3

/

%

8

8

Oswego County — outside the following, see Part 2

Fulton (city)

FU H3535

4%

Oswego (city) — For sales made in the city of Oswego, see Part 2.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11