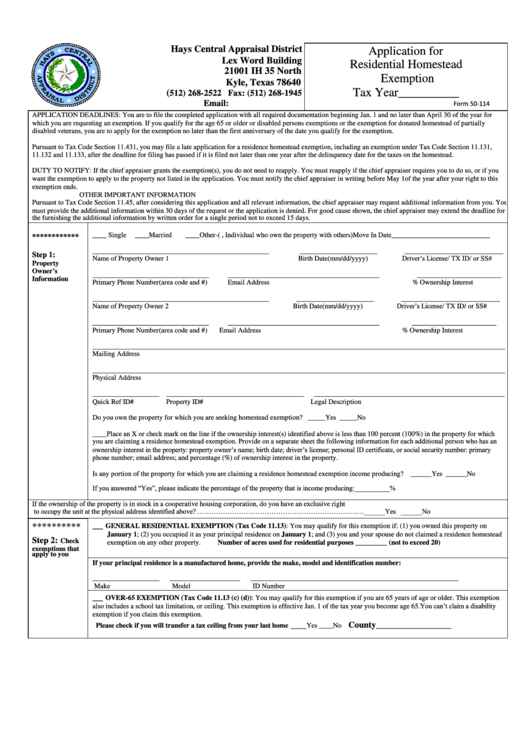

Form 50-114 - Application For Residential Homestead Exemption

ADVERTISEMENT

Hays Central Appraisal District

Application for

Lex Word Building

Residential Homestead

21001 IH 35 North

Exemption

Kyle, Texas 78640

Tax Year__________

(

512) 268-2522 Fax: (512) 268-1945

Form 50-114

APPLICATION DEADLINES: You are to file the completed application with all required documentation beginning Jan. 1 and no later than April 30 of the year for

which you are requesting an exemption. If you qualify for the age 65 or older or disabled persons exemptions or the exemption for donated homestead of partially

disabled veterans, you are to apply for the exemption no later than the first anniversary of the date you qualify for the exemption.

Pursuant to Tax Code Section 11.431, you may file a late application for a residence homestead exemption, including an exemption under Tax Code Section 11.131,

11.132 and 11.133, after the deadline for filing has passed if it is filed not later than one year after the delinquency date for the taxes on the homestead.

DUTY TO NOTIFY: If the chief appraiser grants the exemption(s), you do not need to reapply. You must reapply if the chief appraiser requires you to do so, or if you

want the exemption to apply to the property not listed in the application. You must notify the chief appraiser in writing before May 1of the year after your right to this

exemption ends.

OTHER IMPORTANT INFORMATION

Pursuant to Tax Code Section 11.45, after considering this application and all relevant information, the chief appraiser may request additional information from you. You

must provide the additional information within 30 days of the request or the application is denied. For good cause shown, the chief appraiser may extend the deadline for

the furnishing the additional information by written order for a single period not to exceed 15 days.

____ Single

____Married

____Other-(e.g., Individual who own the property with others) Move In Date____________________________

************

__________________________________________________

______________________

____________________________

Step 1:

Driver’s License/ TX ID/ or SS#

Name of Property Owner 1

Birth Date(mm/dd/yyyy)

Property

Owner’s

_________________________________

___________________________________________

________________________

Information

Primary Phone Number(area code and #)

Email Address

% Ownership Interest

__________________________________________________

______________________

____________________________

Driver’s License/ TX ID/ or SS#

Name of Property Owner 2

Birth Date(mm/dd/yyyy)

_________________________________

___________________________________________

________________________

Primary Phone Number(area code and #)

Email Address

% Ownership Interest

_____________________________________________________________________________________________________________________

Mailing Address

_____________________________________________________________________________________________________________________

Physical Address

___________________ _______________________________________

______________________________________________________

Quick Ref ID#

Property ID#

Legal Description

Do you own the property for which you are seeking homestead exemption? _____Yes _____No

____Place an X or check mark on the line if the ownership interest(s) identified above is less than 100 percent (100%) in the property for which

you are claiming a residence homestead exemption. Provide on a separate sheet the following information for each additional person who has an

ownership interest in the property: property owner’s name; birth date; driver’s license; personal ID certificate, or social security number: primary

phone number; email address; and percentage (%) of ownership interest in the property.

Is any portion of the property for which you are claiming a residence homestead exemption income producing? ______Yes ______No

If you answered “Yes”, please indicate the percentage of the property that is income producing:__________%

If the ownership of the property is in stock in a cooperative housing corporation, do you have an exclusive right

to occupy the unit at the physical address identified above? ………………………………………………………………______Yes ______No

__

**********

GENERAL RESIDENTIAL EXEMPTION (Tax Code 11.13): You may qualify for this exemption if: (1) you owned this property on

January 1; (2) you occupied it as your principal residence on January 1; and (3) you and your spouse do not claimed a residence homestead

Step 2:

Check

exemption on any other property.

Number of acres used for residential purposes _________ (not to exceed 20)

exemptions that

apply to you

If your principal residence is a manufactured home, provide the make, model and identification number:

___________________

____________________

___________________________________________________________

Make

Model

ID Number

__

OVER-65 EXEMPTION (Tax Code 11.13 (c) (d)): You may qualify for this exemption if you are 65 years of age or older. This exemption

also includes a school tax limitation, or ceiling. This exemption is effective Jan. 1 of the tax year you become age 65.You can’t claim a disability

exemption if you claim this exemption.

___

County_________________

Please check if you will transfer a tax ceiling from your last home

Yes

____No

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2