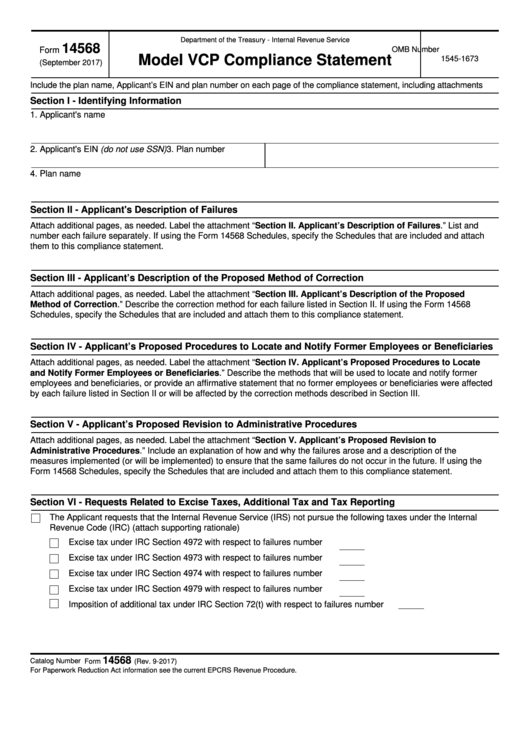

Department of the Treasury - Internal Revenue Service

14568

OMB Number

Form

Model VCP Compliance Statement

1545-1673

(September 2017)

Include the plan name, Applicant’s EIN and plan number on each page of the compliance statement, including attachments

Section I - Identifying Information

1. Applicant's name

2. Applicant's EIN (do not use SSN)

3. Plan number

4. Plan name

Section II - Applicant's Description of Failures

Attach additional pages, as needed. Label the attachment “Section II. Applicant’s Description of Failures.” List and

number each failure separately. If using the Form 14568 Schedules, specify the Schedules that are included and attach

them to this compliance statement.

Section III - Applicant’s Description of the Proposed Method of Correction

Attach additional pages, as needed. Label the attachment “Section III. Applicant’s Description of the Proposed

Method of Correction.” Describe the correction method for each failure listed in Section II. If using the Form 14568

Schedules, specify the Schedules that are included and attach them to this compliance statement.

Section IV - Applicant’s Proposed Procedures to Locate and Notify Former Employees or Beneficiaries

Attach additional pages, as needed. Label the attachment “Section IV. Applicant’s Proposed Procedures to Locate

and Notify Former Employees or Beneficiaries.” Describe the methods that will be used to locate and notify former

employees and beneficiaries, or provide an affirmative statement that no former employees or beneficiaries were affected

by each failure listed in Section II or will be affected by the correction methods described in Section III.

Section V - Applicant’s Proposed Revision to Administrative Procedures

Attach additional pages, as needed. Label the attachment “Section V. Applicant’s Proposed Revision to

Administrative Procedures.” Include an explanation of how and why the failures arose and a description of the

measures implemented (or will be implemented) to ensure that the same failures do not occur in the future. If using the

Form 14568 Schedules, specify the Schedules that are included and attach them to this compliance statement.

Section VI - Requests Related to Excise Taxes, Additional Tax and Tax Reporting

The Applicant requests that the Internal Revenue Service (IRS) not pursue the following taxes under the Internal

Revenue Code (IRC) (attach supporting rationale)

Excise tax under IRC Section 4972 with respect to failures number

Excise tax under IRC Section 4973 with respect to failures number

Excise tax under IRC Section 4974 with respect to failures number

Excise tax under IRC Section 4979 with respect to failures number

Imposition of additional tax under IRC Section 72(t) with respect to failures number

14568

Catalog Number 66138J

Form

(Rev. 9-2017)

For Paperwork Reduction Act information see the current EPCRS Revenue Procedure.

1

1 2

2 3

3 4

4