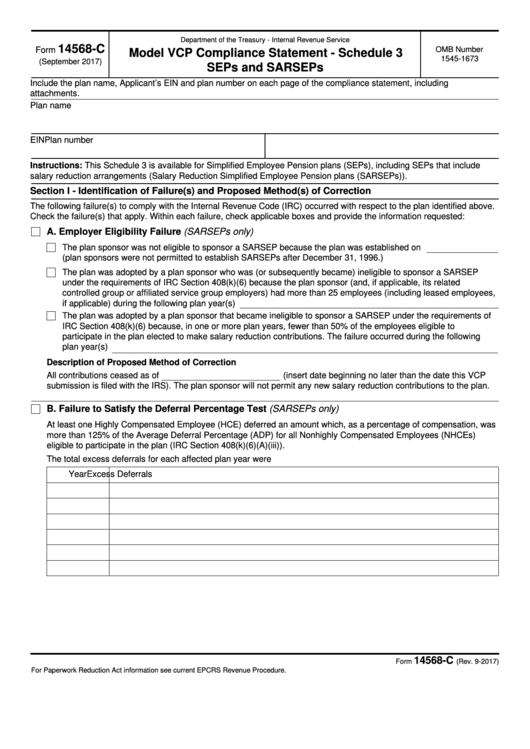

Department of the Treasury - Internal Revenue Service

14568-C

Form

OMB Number

Model VCP Compliance Statement - Schedule 3

1545-1673

(September 2017)

SEPs and SARSEPs

Include the plan name, Applicant’s EIN and plan number on each page of the compliance statement, including

attachments.

Plan name

EIN

Plan number

Instructions: This Schedule 3 is available for Simplified Employee Pension plans (SEPs), including SEPs that include

salary reduction arrangements (Salary Reduction Simplified Employee Pension plans (SARSEPs)).

Section I - Identification of Failure(s) and Proposed Method(s) of Correction

The following failure(s) to comply with the Internal Revenue Code (IRC) occurred with respect to the plan identified above.

Check the failure(s) that apply. Within each failure, check applicable boxes and provide the information requested:

A. Employer Eligibility Failure (SARSEPs only)

The plan sponsor was not eligible to sponsor a SARSEP because the plan was established on

(plan sponsors were not permitted to establish SARSEPs after December 31, 1996.)

The plan was adopted by a plan sponsor who was (or subsequently became) ineligible to sponsor a SARSEP

under the requirements of IRC Section 408(k)(6) because the plan sponsor (and, if applicable, its related

controlled group or affiliated service group employers) had more than 25 employees (including leased employees,

if applicable) during the following plan year(s)

The plan was adopted by a plan sponsor that became ineligible to sponsor a SARSEP under the requirements of

IRC Section 408(k)(6) because, in one or more plan years, fewer than 50% of the employees eligible to

participate in the plan elected to make salary reduction contributions. The failure occurred during the following

plan year(s)

Description of Proposed Method of Correction

All contributions ceased as of

(insert date beginning no later than the date this VCP

submission is filed with the IRS). The plan sponsor will not permit any new salary reduction contributions to the plan.

B. Failure to Satisfy the Deferral Percentage Test (SARSEPs only)

At least one Highly Compensated Employee (HCE) deferred an amount which, as a percentage of compensation, was

more than 125% of the Average Deferral Percentage (ADP) for all Nonhighly Compensated Employees (NHCEs)

eligible to participate in the plan (IRC Section 408(k)(6)(A)(iii)).

The total excess deferrals for each affected plan year were

Year

Excess Deferrals

14568-C

Catalog Number 66147U

Form

(Rev. 9-2017)

For Paperwork Reduction Act information see current EPCRS Revenue Procedure.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8