Senior Freeze Exemption - Cook County Assessor - 2016 Page 2

ADVERTISEMENT

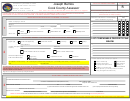

C

C

A

OOK

OUNTY

SSESSOR

J

B

OSEPH

ERRIOS

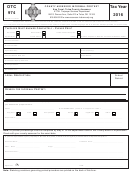

201 SENIOR FREEZE EXEMPTION

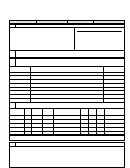

7. My total household income, including my income and the income of all persons listed on number 6 on the

previous page, for income ax ear 201 , was (use the instructions on the next page):

$

A

Social Security

SSI benefits nclude Medicare deductions .………………………..…..

B

Railroad Retirement benefits nclude Medicare deductions ….………………………....

C

Civil Service benefits……………………………………………………..………………...

D

Annuity benefits and federally taxable pension and IRA benefits……...………………...

E

Human Services and other governmental assistance……………………………….….....

F

Wages, salaries and tips from work….…………………………………………………..

G

Interest and dividends received…………………….………………………..………….…....

H

Net rental, farm and business income (or loss) …………………………..….……...…….

I

Net capital gain (or loss)……….………….…………………………………..………………..

J

Other income (or loss)……………………………………………………….………………....

K

Add Lines A through J………………………………………….………………..………….

L

Subtractions…………………...…………………….………………….……

..

M

Subtract Line L from Line K and

the result………………..…………………

....

If Line M is MORE THAN $55,000 ,

you do not qualify for the Senior Freeze Exemption

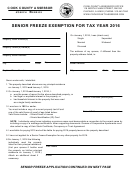

Under penalt

of perjury, I state that, to

Applicant's Name

the best of my knowledge, the information

contained in this affidavit is true, correct

and complete.

Applicant's Signature

Please note: This exemption is subject to

Date

audit by the Cook County Assessor’s Office.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4