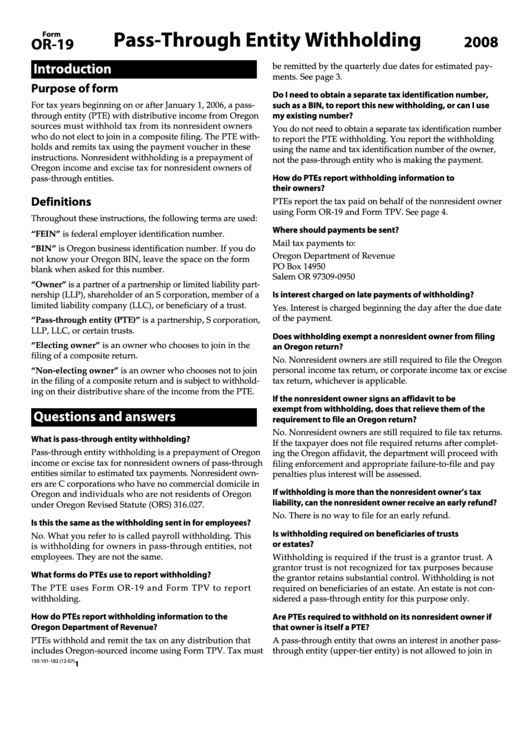

Form Or-19 - Pass-Through Entity Withholding - 2008

ADVERTISEMENT

Pass-Through Entity Withholding

Form

2008

OR-19

Introduction

be remitted by the quarterly due dates for estimated pay-

ments. See page 3.

Purpose of form

Do I need to obtain a separate tax identification number,

such as a BIN, to report this new withholding, or can I use

For tax years beginning on or after January 1, 2006, a pass-

my existing number?

through entity (PTE) with distributive income from Oregon

sources must withhold tax from its nonresident owners

You do not need to obtain a separate tax identification number

who do not elect to join in a composite filing. The PTE with-

to report the PTE withholding. You report the withholding

holds and remits tax using the payment voucher in these

using the name and tax identification number of the owner,

instructions. Nonresident withholding is a prepayment of

not the pass-through entity who is making the payment.

Oregon income and excise tax for nonresident owners of

How do PTEs report withholding information to

pass-through entities.

their owners?

Definitions

PTEs report the tax paid on behalf of the nonresident owner

using Form OR-19 and Form TPV. See page 4.

Throughout these instructions, the following terms are used:

Where should payments be sent?

“FEIN” is federal employer identification number.

Mail tax payments to:

“BIN” is Oregon business identification number. If you do

Oregon Department of Revenue

not know your Oregon BIN, leave the space on the form

PO Box 14950

blank when asked for this number.

Salem OR 97309-0950

“Owner” is a partner of a partnership or limited liability part-

Is interest charged on late payments of withholding?

nership (LLP), shareholder of an S corporation, member of a

limited liability company (LLC), or beneficiary of a trust.

Yes. Interest is charged beginning the day after the due date

of the payment.

“Pass-through entity (PTE)” is a partnership, S corporation,

LLP, LLC, or certain trusts.

Does withholding exempt a nonresident owner from filing

“Electing owner” is an owner who chooses to join in the

an Oregon return?

filing of a composite return.

No. Nonresident owners are still required to file the Oregon

“Non-electing owner” is an owner who chooses not to join

personal income tax return, or corporate income tax or excise

in the filing of a composite return and is subject to withhold-

tax return, whichever is applicable.

ing on their distributive share of the income from the PTE.

If the nonresident owner signs an affidavit to be

exempt from withholding, does that relieve them of the

Questions and answers

requirement to file an Oregon return?

No. Nonresident owners are still required to file tax returns.

What is pass-through entity withholding?

If the taxpayer does not file required returns after complet-

Pass-through entity withholding is a prepayment of Oregon

ing the Oregon affidavit, the department will proceed with

income or excise tax for nonresident owners of pass-through

filing enforcement and appropriate failure-to-file and pay

entities similar to estimated tax payments. Nonresident own-

penalties plus interest will be assessed.

ers are C corporations who have no commercial domicile in

If withholding is more than the nonresident owner’s tax

Oregon and individuals who are not residents of Oregon

liability, can the nonresident owner receive an early refund?

under Oregon Revised Statute (ORS) 316.027.

No. There is no way to file for an early refund.

Is this the same as the withholding sent in for employees?

Is withholding required on beneficiaries of trusts

No. What you refer to is called payroll withholding. This

or estates?

is withholding for owners in pass-through entities, not

employees. They are not the same.

Withholding is required if the trust is a grantor trust. A

grantor trust is not recognized for tax purposes because

What forms do PTEs use to report withholding?

the grantor retains substantial control. Withholding is not

The PTE uses Form OR-19 and Form TPV to report

required on beneficiaries of an estate. An estate is not con-

withholding.

sidered a pass-through entity for this purpose only.

How do PTEs report withholding information to the

Are PTEs required to withhold on its nonresident owner if

Oregon Department of Revenue?

that owner is itself a PTE?

PTEs withhold and remit the tax on any distribution that

A pass-through entity that owns an interest in another pass-

includes Oregon-sourced income using Form TPV. Tax must

through entity (upper-tier entity) is not allowed to join in

150-101-182 (12-07)

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5