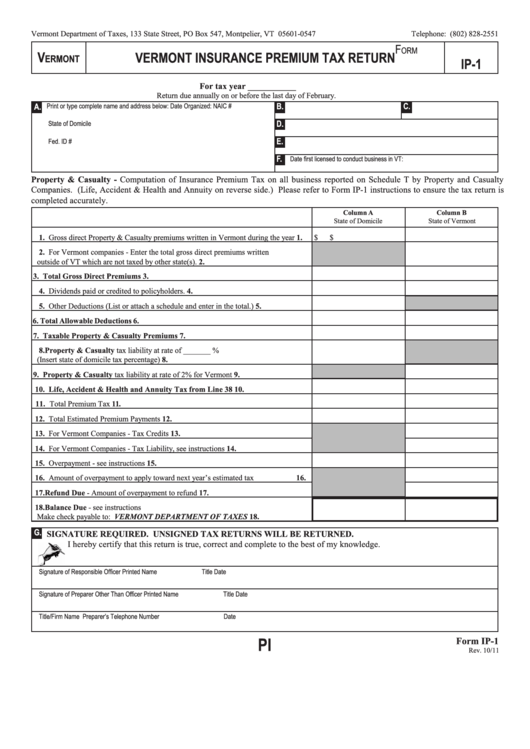

Vermont Department of Taxes, 133 State Street, PO Box 547, Montpelier, VT 05601-0547

Telephone: (802) 828-2551

F

orm

V

VERMONT INSURANCE PREMIUM TAX RETURN

ermont

IP-1

For tax year ___________

Return due annually on or before the last day of February.

B.

C.

A.

Print or type complete name and address below:

Date Organized:

NAIC #

D.

State of Domicile

E.

Fed. ID #

F.

Date first licensed to conduct business in VT:

Property & Casualty - Computation of Insurance Premium Tax on all business reported on Schedule T by Property and Casualty

Companies. (Life, Accident & Health and Annuity on reverse side.) Please refer to Form IP-1 instructions to ensure the tax return is

completed accurately.

Column A

Column B

State of Domicile

State of Vermont

1. Gross direct Property & Casualty premiums written in Vermont during the year 1.

$

$

2. For Vermont companies - Enter the total gross direct premiums written

outside of VT which are not taxed by other state(s).

2.

3. Total Gross Direct Premiums

3.

4. Dividends paid or credited to policyholders.

4.

5. Other Deductions (List or attach a schedule and enter in the total.)

5.

6. Total Allowable Deductions

6.

7. Taxable Property & Casualty Premiums

7.

8. Property & Casualty tax liability at rate of _______ %

(Insert state of domicile tax percentage)

8.

9. Property & Casualty tax liability at rate of 2% for Vermont

9.

10. Life, Accident & Health and Annuity Tax from Line 38

10.

11. Total Premium Tax

11.

12. Total Estimated Premium Payments

12.

13. For Vermont Companies - Tax Credits

13.

14. For Vermont Companies - Tax Liability, see instructions

14.

15. Overpayment - see instructions

15.

16. Amount of overpayment to apply toward next year’s estimated tax

16.

17. Refund Due - Amount of overpayment to refund

17.

18. Balance Due - see instructions

Make check payable to: VERMONT DEPARTMENT OF TAXES

18.

G.

SIGNATURE REQUIRED. UNSIGNED TAX RETURNS WILL BE RETURNED.

I hereby certify that this return is true, correct and complete to the best of my knowledge.

Signature of Responsible Officer

Printed Name

Title

Date

Signature of Preparer Other Than Officer

Printed Name

Title

Date

Title/Firm Name

Preparer’s Telephone Number

Date

PI

Form IP-1

Rev. 10/11

1

1 2

2