Form Vb-1 - Vermont Vinous Beverage Tax Return

ADVERTISEMENT

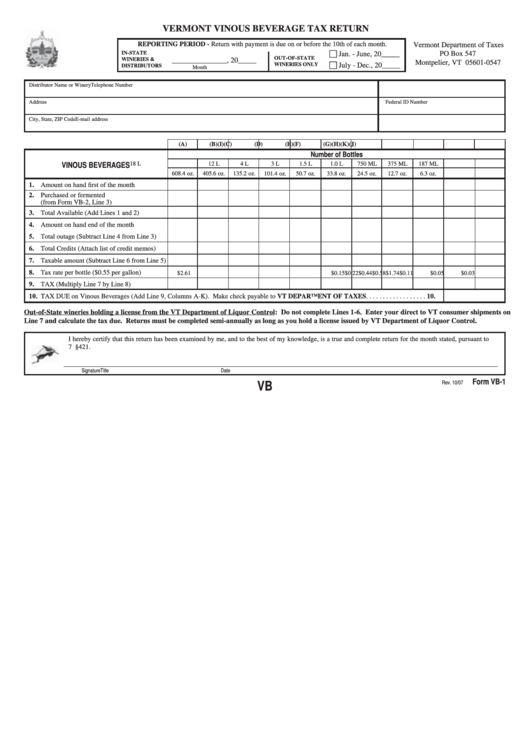

VERMONT VINOUS BEVERAGE TAX RETURN

REPORTING PERIOD - Return with payment is due on or before the 10th of each month.

Vermont Department of Taxes

IN-STATE

PO Box 547

Jan. - June, 20_____

OUT-OF-STATE

WINERIES &

_______________, 20_____

Montpelier, VT 05601-0547

WINERIES ONLY

July - Dec., 20_____

DISTRIBUTORS

Month

Distributor Name or Winery

Telephone Number

Address

Federal ID Number

City, State, ZIP Code

E-mail address

(A)

(B)

(C)

(D)

(E)

(F)

(G)

(H)

(I)

(J)

(K)

Number of Bottles

18 L

12 L

4 L

3 L

1.5 L

1.0 L

750 ML

375 ML

187 ML

VINOUS BEVERAGES

608.4 oz.

405.6 oz.

135.2 oz.

101.4 oz.

50.7 oz.

33.8 oz.

24.5 oz.

12.7 oz.

6.3 oz.

1. Amount on hand first of the month

2. Purchased or fermented

(from Form VB-2, Line 3)

3. Total Available (Add Lines 1 and 2)

4. Amount on hand end of the month

5. Total outage (Subtract Line 4 from Line 3)

6. Total Credits (Attach list of credit memos)

7. Taxable amount (Subtract Line 6 from Line 5)

8. Tax rate per bottle ($0.55 per gallon)

$2.61

$1.74

$0.58

$0.44

$0.22

$0.15

$0.11

$0.05

$0.03

9. TAX (Multiply Line 7 by Line 8)

10. TAX DUE on Vinous Beverages (Add Line 9, Columns A-K). Make check payable to VT DEPARTMENT OF TAXES . . . . . . . . . . . . . . . . . . 10.

Out-of-State wineries holding a license from the VT Department of Liquor Control: Do not complete Lines 1-6. Enter your direct to VT consumer shipments on

Line 7 and calculate the tax due. Returns must be completed semi-annually as long as you hold a license issued by VT Department of Liquor Control.

I hereby certify that this return has been examined by me, and to the best of my knowledge, is a true and complete return for the month stated, pursuant to

7 V.S.A. §421.

Signature

Title

Date

Form VB-1

Rev. 10/07

VB

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1