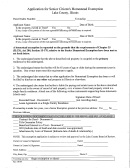

Application For Senior Citizen Low Income Special Real Estate Tax Provisions - City Of Philadelphia - 2010 Page 2

ADVERTISEMENT

INSTRUCTIONS

If you participated in this program last year, it is not necessary to complete

this application as you are automatically enrolled in the program this year.

To qualify, total income must be $23,500 or less for a single person

or $31,500 or less for a married couple.

Print your Property Address and the Real Estate Tax account number.

Print the owner's name, Social Security number, and birth date. Check the box indicating

the appropriate Filing Status. If you check "Married", print spouse's name, Social Security

number and birth date. If the qualifying spouse is deceased, enter the date of death.

You or your spouse must be 65 years of age or older, or you must be over 50 years of age

and your deceased spouse was at least 65 years old at the time of their death. You must

send proof of age with your application. Do not send original documents; only

photocopies will be accepted. Examples of proof of age are a Social Security award

letter, driver's license or birth certificate. Any document that clearly shows a date of birth

will be accepted for consideration.

Complete the Household Income section as indicated. Documentation for proof of income

MAY be requested at the discretion of the Philadelphia Department of Revenue. The

Philadelphia Department of Revenue is authorized to perform an income verification

check with the Internal Revenue Service and the Pennsylvania Department of Revenue

Bureau of Individual Taxes. If at any time your income is found to exceed the program

limits, you will be billed for additional monies due.

Sign and date the application, include your daytime telephone number.

MAIL TO: PHILADELPHIA DEPARTMENT OF REVENUE

P.O. BOX 53190

PHILADELPHIA, PA 19105

QUESTIONS: 215-686-6442

E-mail: revenue@phila.gov

IMPORTANT NOTES

For timely processing, complete and return this application by October 15, 2009.

For successful applicants, your savings will be reflected on your 2010 Real Estate Tax bill.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2