Instructions For Form It-47 - Request For Municipal Income Tax Account

ADVERTISEMENT

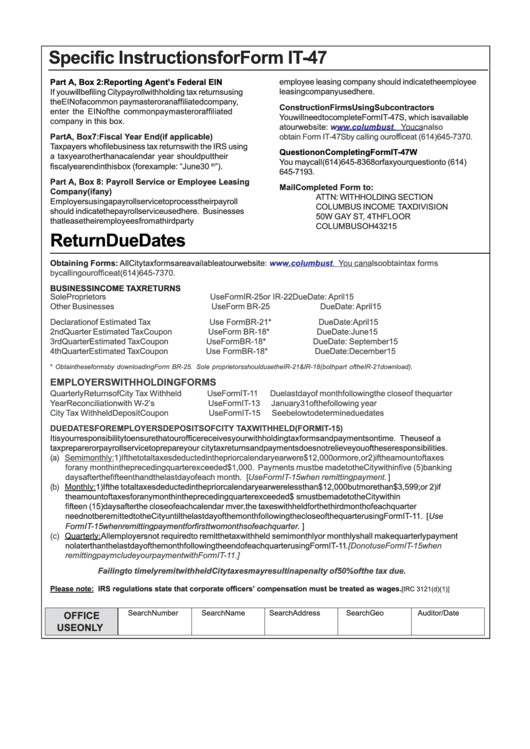

Specific Instructions for Form IT-47

employee leasing company should indicate the employee

Part A, Box 2: Reporting Agent’s Federal EIN

If you will be filing City payroll withholding tax returns using

leasing company used here.

the EIN of a common paymaster or an affiliated company,

Construction Firms Using Subcontractors

enter the EIN of the common paymaster or affiliated

You will need to complete Form IT-47S, which is available

company in this box.

at our website:

You can also

obtain Form IT-47S by calling our office at (614) 645-7370.

Part A, Box 7: Fiscal Year End (if applicable)

Taxpayers who file business tax returns with the IRS using

Question on Completing Form IT-47W

a tax year other than a calendar year should put their

You may call (614) 645-8368 or fax your question to (614)

fiscal year end in this box (for example: “June 30

”).

th

645-7193.

Part A, Box 8: Payroll Service or Employee Leasing

Mail Completed Form to:

Company (if any)

ATTN: WITHHOLDING SECTION

Employers using a payroll service to process their payroll

COLUMBUS INCOME TAX DIVISION

should indicate the payroll service used here. Businesses

50 W GAY ST, 4TH FLOOR

that lease their employees from a third party

COLUMBUS OH 43215

Return Due Dates

Obtaining Forms: All City tax forms are available at our website:

You can also obtain tax forms

by calling our office at (614) 645-7370.

BUSINESS INCOME TAX RETURNS

Sole Proprietors

Use Form IR-25 or IR-22

Due Date: April 15

Other Businesses

Use Form BR-25

Due Date: April 15

Declaration of Estimated Tax

Use Form BR-21*

Due Date: April 15

2nd Quarter Estimated Tax Coupon

Use Form BR-18*

Due Date: June 15

3rd Quarter Estimated Tax Coupon

Use Form BR-18*

Due Date: September 15

4th Quarter Estimated Tax Coupon

Use Form BR-18*

Due Date: December 15

* Obtain these forms by downloading Form BR-25. Sole proprietors should use the IR-21 & IR-18 (both part of the IR-21 download).

EMPLOYERS WITHHOLDING FORMS

Quarterly Returns of City Tax Withheld

Use Form IT-11

Due last day of month following the close of the quarter

Year Reconciliation with W-2’s

Use Form IT-13

January 31 of the following year

City Tax Withheld Deposit Coupon

Use Form IT-15

See below to determine due dates

DUE DATES FOR EMPLOYERS DEPOSITS OF CITY TAX WITHHELD (FORM IT-15)

It is your responsibility to ensure that our office receives your withholding tax forms and payments on time. The use of a

tax preparer or payroll service to prepare your city tax returns and payments does not relieve you of these responsibilities.

(a) Semimonthly: 1) If the total taxes deducted in the prior calendar year were $12,000 or more, or 2) if the amount of taxes

for any month in the preceding quarter exceeded $1,000. Payments must be made to the City within five (5) banking

days after the fifteenth and the last day of each month. [ Use Form IT-15 when remitting payment. ]

(b)

Monthly: 1) If the total taxes deducted in the prior calendar year were less than $12,000 but more than $3,599; or 2) if

the amount of taxes for any month in the preceding quarter exceeded $300. Payments must be made to the City within

fifteen (15) days after the close of each calendar month. However, the taxes withheld for the third month of each quarter

need not be remitted to the City until the last day of the month following the close of the quarter using Form IT-11. [Use

Form IT-15 when remitting payment for first two months of each quarter. ]

(c)

Quarterly: All employers not required to remit the tax withheld semimonthly or monthly shall make quarterly payment

no later than the last day of the month following the end of each quarter using Form IT-11

. [Do not use Form IT-15 when

remitting payment. Include your payment with Form IT-11.]

Failing to timely remit withheld City taxes may result in a penalty of 50% of the tax due.

Please note: IRS regulations state that corporate officers’ compensation must be treated as wages.

[IRC 3121(d)(1)]

Search Number

Search Name

Search Address

Search Geo

Auditor/Date

OFFICE

USE ONLY

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1