Form I106 - Reconciliation Of Earned Income Tax Withheld Wages

ADVERTISEMENT

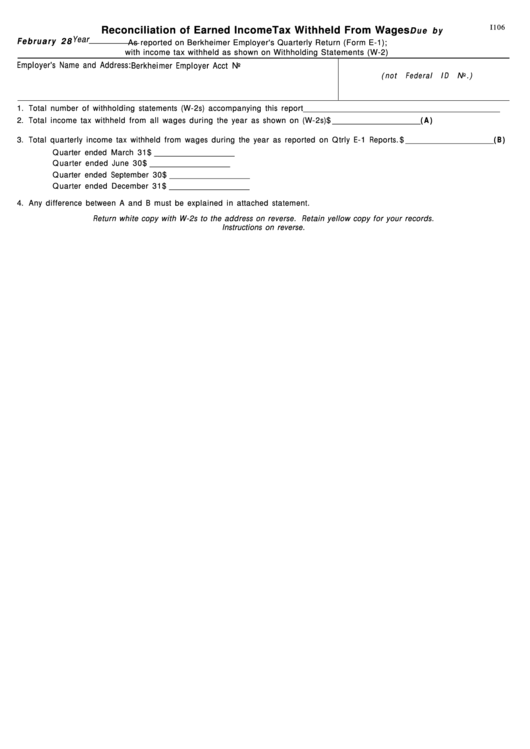

I106

D u e b y

Reconciliation of Earned IncomeTax Withheld From Wages

Year ___________

F e b r u a r y 2 8

As reported on Berkheimer Employer's Quarterly Return (Form E-1);

with income tax withheld as shown on Withholding Statements (W-2)

Employer's Name and Address:

Berkheimer Employer Acct No

(not

Federal

ID

No.)

1. Total number of withholding statements (W-2s) accompanying this report _________________________________________________

2. Total income tax withheld from all wages during the year as shown on (W-2s) ............................. $ ______________________( A )

3. Total quarterly income tax withheld from wages during the year as reported on Qtrly E-1 Reports . $ ______________________( B )

Quarter ended March 31 ...................................................... $ ____________________

Quarter ended June 30 ........................................................ $ ____________________

Quarter ended September 30 ................................................ $ ____________________

Quarter ended December 31 ................................................. $ ____________________

4. Any difference between A and B must be explained in attached statement.

Return white copy with W-2s to the address on reverse. Retain yellow copy for your records.

Instructions on reverse.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1