Form Ibr-1 - Idaho Business Registration Form Page 2

ADVERTISEMENT

EFO00147-2

Revised

01-07-14

2014

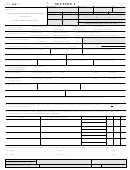

27. Expected number of Idaho employees

25. Date employees first hired to work in Idaho

26. Date of employees' first paycheck in Idaho

28. Enter the amount of wages you have paid or plan to pay in Idaho. If you haven't paid or don't plan to pay wages during one of the periods listed, enter

"NONE."

Jan. 1 to March 31

April 1 to June 30

July 1 to Sept. 30

Oct. 1 to Dec. 31

Current

Year

Preceding

Year

29. If you estimated wages in #28, enter the date you plan to begin paying wages. _____________________

30. Will corporate officers receive compensation, salary or distribution of profits? ___ Yes

___ No

31. Were you subject to the Federal Unemployment Tax Act during the current or preceding year? ___ Yes

___ No

32. Is this an organization exempt from income tax under Internal Revenue Service Code 501(c)(3)? ___ Yes

___ No

33. Do you want more information about unemployment insurance for nonprofit corporations? (see instructions) ___ Yes

___ No

34. Is workers' compensation insurance needed? (see instructions) ___Yes

___ No, explain why:

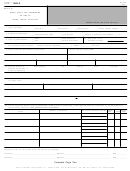

CAUTION: This is not an application for workers' compensation insurance

37. Insurance agent's name and telephone number

35. Do you have a workers' compensation

36. Have you notified your insurance company that

you have or expect to have Idaho payroll?

insurance policy?

(

)

___ Yes

___ No ___ In process

___ Yes

___ No

38. Insurance company name

39. Policy number

40. Effective date

41. If applying for insurance with the Idaho State Insurance

Fund, list application number:

42. Do you plan to perform work in other states using your existing Idaho employees? ___ Yes ___ No

If yes, which states? _____________________

WAGE THRESHOLDS LISTED BELOW DO NOT AFFECT AN EMPLOYER'S OBLIGATION TO CARRY WORKERS' COMPENSATION INSURANCE.

43. For most employers:

a) Have you had or will you have 1 or more workers (for any day or portion of a day) in 20 weeks or more in any calendar year? ____ Yes ____ No

b) Have you paid or will you pay $1,500 or more in wages during any calendar quarter? ____ Yes ____ No

c) If yes, indicate the earliest quarter and calendar year. _____________________

quarter

year

44. For agricultural employers only:

a) Have you had or will you have 10 or more workers (for any day or portion of a day) in 20 weeks or more in any calendar year? ____ Yes ____ No

b) Have you paid or will you pay $20,000 or more in cash wages during any calendar quarter? ____ Yes ____ No

c) If yes, indicate the earliest quarter and calendar year. _____________________

quarter

year

45. For domestic help employers only:

a) If you are an individual, local college club, or chapter of a college fraternity or sorority, have you paid or will you pay $1,000 or more in cash

wages in the state of Idaho during any calendar quarter? ____ Yes ____ No

b) If yes, indicate the earliest quarter and calendar year. _____________________

quarter

year

ACQUIRING AN EXISTING BUSINESS OR CHANGING TYPE OF LEGAL BUSINESS ENTITY

If you buy an existing business, or change your business entity, Idaho law requires you to withhold enough of the purchase money to pay any sales tax and, in

most cases, unemployment insurance due or unpaid by the previous owner/entity until the previous owner/entity produces a receipt from the Idaho Department

of Labor and the Idaho State Tax Commission showing the taxes have been paid. If you fail to withhold the required purchase money and the taxes remain

due and unpaid after the business is sold or converted to another entity type, you may be liable for the payment of the taxes collected or unpaid by the former

owner/entity. When there is a change in the legal entity, you must notify your workers' compensation insurance company.

46. Did you acquire all or part of an existing business? ___ All ___ Part ___ None

47. Did you change your legal business entity? ___ Yes ___ No

48. Previous owner's name

49. Business name at time of purchase

50. Date acquired/changed

52. Do you want to receive a form to apply for the unemployment

51. Account/permit numbers of the business acquired/changed

insurance experience rating of your predecessor?

____ Yes ____ No

PUBLICATION CONSENT

53. Yes, I agree to publish my business by category both in print and on the Internet in the Business Directory of Idaho at lmi.idaho.gov and any publication

produced by the Idaho Department of Labor. This will increase visibility of my business to a larger pool of job applicants, will allow my business to be

included when the Department of Labor responds to questions about the availability of products and services in the community, and expand the opportunity

for additional sales. I acknowledge the Idaho Department of Labor's files will be accessed to obtain my company name, address, phone number, NAICS

(industry) code and range of employment.

Signature_______________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2