Instructions For California Withholding Schedules - Method B - Exact Calculation Method - 2001

ADVERTISEMENT

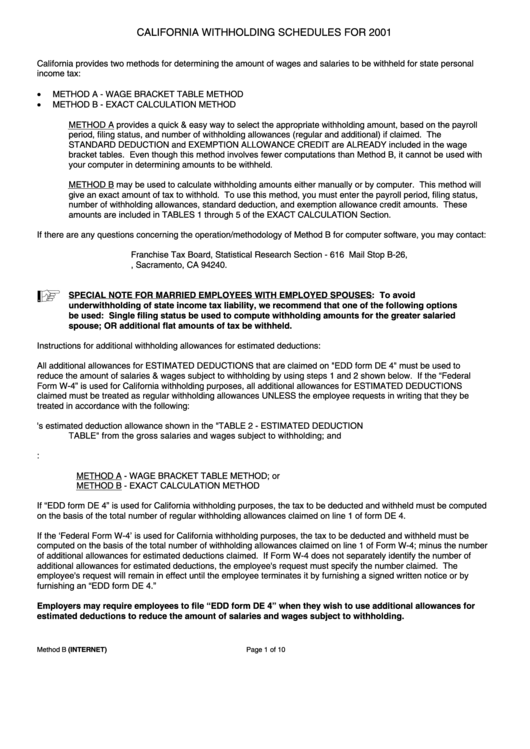

CALIFORNIA WITHHOLDING SCHEDULES FOR 2001

California provides two methods for determining the amount of wages and salaries to be withheld for state personal

income tax:

•

METHOD A - WAGE BRACKET TABLE METHOD

•

METHOD B - EXACT CALCULATION METHOD

METHOD A provides a quick & easy way to select the appropriate withholding amount, based on the payroll

period, filing status, and number of withholding allowances (regular and additional) if claimed. The

STANDARD DEDUCTION and EXEMPTION ALLOWANCE CREDIT are ALREADY included in the wage

bracket tables. Even though this method involves fewer computations than Method B, it cannot be used with

your computer in determining amounts to be withheld.

METHOD B may be used to calculate withholding amounts either manually or by computer. This method will

give an exact amount of tax to withhold. To use this method, you must enter the payroll period, filing status,

number of withholding allowances, standard deduction, and exemption allowance credit amounts. These

amounts are included in TABLES 1 through 5 of the EXACT CALCULATION Section.

If there are any questions concerning the operation/methodology of Method B for computer software, you may contact:

Franchise Tax Board, Statistical Research Section - 616 Mail Stop B-26,

P.O. Box 942840, Sacramento, CA 94240.

SPECIAL NOTE FOR MARRIED EMPLOYEES WITH EMPLOYED SPOUSES: To avoid

underwithholding of state income tax liability, we recommend that one of the following options

be used: Single filing status be used to compute withholding amounts for the greater salaried

spouse; OR additional flat amounts of tax be withheld.

Instructions for additional withholding allowances for estimated deductions:

All additional allowances for ESTIMATED DEDUCTIONS that are claimed on "EDD form DE 4" must be used to

reduce the amount of salaries & wages subject to withholding by using steps 1 and 2 shown below. If the “Federal

Form W-4” is used for California withholding purposes, all additional allowances for ESTIMATED DEDUCTIONS

claimed must be treated as regular withholding allowances UNLESS the employee requests in writing that they be

treated in accordance with the following:

1.

Subtract the employee's estimated deduction allowance shown in the "TABLE 2 - ESTIMATED DEDUCTION

TABLE" from the gross salaries and wages subject to withholding; and

2.

Compute the tax to be withheld using:

METHOD A - WAGE BRACKET TABLE METHOD; or

METHOD B - EXACT CALCULATION METHOD

If “EDD form DE 4” is used for California withholding purposes, the tax to be deducted and withheld must be computed

on the basis of the total number of regular withholding allowances claimed on line 1 of form DE 4.

If the ‘Federal Form W-4’ is used for California withholding purposes, the tax to be deducted and withheld must be

computed on the basis of the total number of withholding allowances claimed on line 1 of Form W-4; minus the number

of additional allowances for estimated deductions claimed. If Form W-4 does not separately identify the number of

additional allowances for estimated deductions, the employee's request must specify the number claimed. The

employee's request will remain in effect until the employee terminates it by furnishing a signed written notice or by

furnishing an “EDD form DE 4.”

Employers may require employees to file “EDD form DE 4” when they wish to use additional allowances for

estimated deductions to reduce the amount of salaries and wages subject to withholding.

Method B (INTERNET)

Page 1 of 10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10