Instructions For Claims Based On Credit(S) Form Nyc-8 - 2001

ADVERTISEMENT

Form NYC-8 - 2001

Page 2

in the three-year period, but is filed within the two-

G

I

E N E R A L

N F O R M A T I O N

year period, the amount of credit or refund cannot

exceed the portion of the tax paid during the two

Note: The provisions of section 11-602 relating to the definition

years immediately preceding the filing of the claim.

of subsidiary capital and investment capital and limiting certain

deductions relating to certain mergers and acquisitions have

3. If the period for assessing the tax has been extended

been repealed for taxable years beginning after 1999.

by agreement between the taxpayer and the

For information regarding depreciation deductions for property

Department of Finance, the claim for refund or credit

placed in service outside New York after 1984 and before 1994,

must be made within six months after the expiration

see the separate “Addendum to Instructions for Forms Relating

of the period.

toFinance Memorandum 99-4 “Depreciation for Property Placed

4. If a timely petition for the redetermination of a defi-

in Service Outside New York After 1984 and Before 1994”

ciency has been filed, no separate claim for credit or

included with these materials.

refund need be filed for that year.

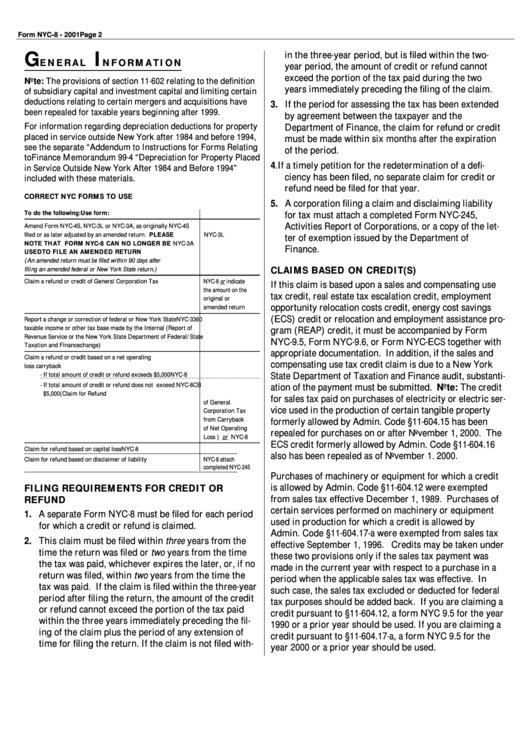

CORRECT NYC FORMS TO USE

5. A corporation filing a claim and disclaiming liability

To do the following:

Use form:

for tax must attach a completed Form NYC-245,

Activities Report of Corporations, or a copy of the let-

Amend Form NYC-4S, NYC-3L or NYC-3A, as originally

NYC-4S

filed or as later adjusted by an amended return. PLEASE

NYC-3L

ter of exemption issued by the Department of

NOTE THAT FORM NYC-8 CAN NO LONGER BE

NYC-3A

Finance.

USED TO FILE AN AMENDED RETURN

(An amended return must be filed within 90 days after

CLAIMS BASED ON CREDIT(S)

filing an amended federal or New York State return.)

Claim a refund or credit of General Corporation Tax

NYC-8 or indicate

If this claim is based upon a sales and compensating use

the amount on the

tax credit, real estate tax escalation credit, employment

original or

opportunity relocation costs credit, energy cost savings

amended return

(ECS) credit or relocation and employment assistance pro-

Report a change or correction of federal or New York State

NYC-3360

taxable income or other tax base made by the Internal

(Report of

gram (REAP) credit, it must be accompanied by Form

Revenue Service or the New York State Department of

Federal/State

NYC-9.5, Form NYC-9.6, or Form NYC-ECS together with

Taxation and Finance

change)

appropriate documentation. In addition, if the sales and

Claim a refund or credit based on a net operating

compensating use tax credit claim is due to a New York

loss carryback

State Department of Taxation and Finance audit, substanti-

- If total amount of credit or refund exceeds $5,000

NYC-8

- If total amount of credit or refund does not exceed

NYC-8CB

ation of the payment must be submitted. Note: The credit

$5,000

(Claim for Refund

for sales tax paid on purchases of electricity or electric ser-

of General

vice used in the production of certain tangible property

Corporation Tax

from Carryback

formerly allowed by Admin. Code §11-604.15 has been

of Net Operating

repealed for purchases on or after November 1, 2000. The

Loss ) or NYC-8

ECS credit formerly allowed by Admin. Code §11-604.16

Claim for refund based on capital loss

NYC-8

_____________________________________________________________

also has been repealed as of November 1. 2000.

Claim for refund based on disclaimer of liability

NYC-8 attach

completed NYC-245

_____________________________________________________________

Purchases of machinery or equipment for which a credit

is allowed by Admin. Code §11-604.12 were exempted

FILING REQUIREMENTS FOR CREDIT OR

from sales tax effective December 1, 1989. Purchases of

REFUND

certain services performed on machinery or equipment

1. A separate Form NYC-8 must be filed for each period

used in production for which a credit is allowed by

for which a credit or refund is claimed.

Admin. Code §11-604.17-a were exempted from sales tax

2. This claim must be filed within three years from the

effective September 1, 1996. Credits may be taken under

time the return was filed or two years from the time

these two provisions only if the sales tax payment was

the tax was paid, whichever expires the later, or, if no

made in the current year with respect to a purchase in a

return was filed, within two years from the time the

period when the applicable sales tax was effective. In

tax was paid. If the claim is filed within the three-year

such case, the sales tax excluded or deducted for federal

period after filing the return, the amount of the credit

tax purposes should be added back. If you are claiming a

or refund cannot exceed the portion of the tax paid

credit pursuant to §11-604.12, a form NYC 9.5 for the year

within the three years immediately preceding the fil-

1990 or a prior year should be used. If you are claiming a

ing of the claim plus the period of any extension of

credit pursuant to §11-604.17-a, a form NYC 9.5 for the

time for filing the return. If the claim is not filed with-

year 2000 or a prior year should be used.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3