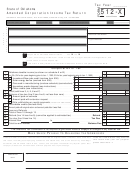

Form 512-X - Page 2

Schedule A

Schedule A is for corporations whose income is all within Oklahoma and/or for corporations whose

income is partly within and partly without Oklahoma (not unitary). Enclose a complete copy of your

Federal return. (1120-X,1139 or amended 1120)

Important: All applicable lines and

Column A

Column B

schedules must be filled in.

As reported on

Total applicable

Gross Income

(lines 1 through 11)

Federal Return

to Oklahoma

1

Gross receipts or gross sales __________ (less: returns and allowances) . . .

1

2

Less: Cost of goods sold . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3

Gross profit (line 1 minus line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4

Dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5

Interest on obligations of the United States and U.S. Instrumentalities . . . . . .

5

6

(a) Other interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6a

(b) Municipal interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6b

7

Gross rents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8

Gross royalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9

(a) Net capital gains . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9a

(b) Ordinary gain or [loss] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9b

10

Other income (enclose schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11

Total income (add lines 3 through 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

Deductions

(lines 12 through 27)

12

Compensation of officers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

13

Salaries and wages . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

14

Repairs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

15

Bad debts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

16

Rents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

17

Taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

18

Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

19

Contributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

20

Amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

21

Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

22

Depletion (see instructions below) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

23

Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

24

Pension, profit-sharing plans, etc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

25

Employee benefit programs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25

26

Other deductions (enclose schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

27

Total Deductions (add lines 12 through 26) . . . . . . . . . . . . . . . . . . . . . . . . . .

27

Totals

(lines 28 through 30)

28

Taxable income before net operating loss deductions and special deductions

28

29

Less: (a) Net operating loss deduction (schedule) . . . . . . . . . . . . . . . . . . . . .

29a

(b) Special deductions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

29b

30

Taxable income (line 28 minus lines 29a & b) Enter here and line 1, page 1 . .

30

Note: Indicate method used to allocate expenses to Oklahoma and enclose schedule of computations.

Oklahoma Depletion in Lieu of Federal Depletion

Oklahoma depletion on oil and gas may be computed at 22 % of gross income derived from each Oklahoma property during the taxable year but limited to 50% of the

net income from such property (computed without the allowance for depletion) for 1996 tax years and prior and for tax year 2000. For tax years 1997 through 1999 and

for tax year 2001 and subsequent, only major oil companies, as defined in section 288.2 of Title 52 of the Oklahoma Statutes, when computing Oklahoma depletion shall

be limited to 50% of the net income from each property. A depletion schedule by property must be enclosed with return. Note: General and administrative expense

(computed on basis of Oklahoma direct expense to total direct expense) must be deducted before applying the 50% test.

Explanation or Reason for Amended Return

(Enclose all necessary schedules, including RAR’s)

1

1 2

2 3

3 4

4