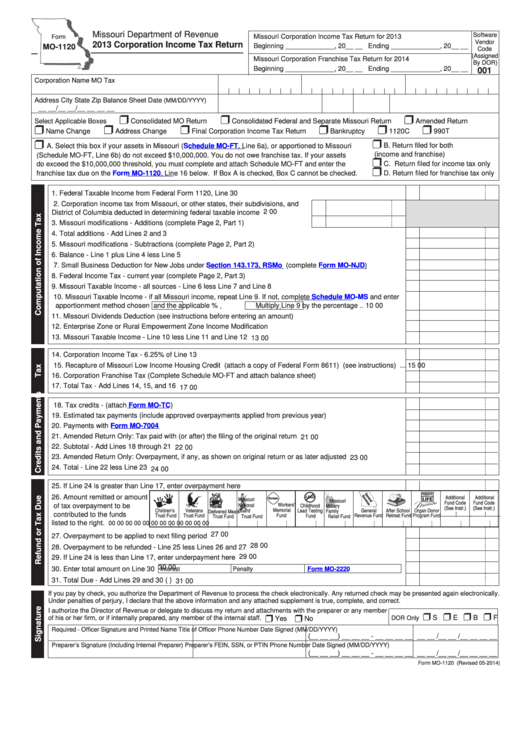

Form Mo-1120 - 2013 Corporation Income Tax Return - State Of Missouri

ADVERTISEMENT

Reset Form

Print Form

Missouri Department of Revenue

Software

Missouri Corporation Income Tax Return for 2013

Form

Vendor

2013 Corporation Income Tax Return

MO-1120

Beginning _____________, 20__ __ Ending _____________, 20__ __

Code

(Assigned

Missouri Corporation Franchise Tax Return for 2014

By DOR)

Beginning _____________, 20__ __ Ending _____________, 20__ __

001

Corporation Name

MO Tax I.D. Number

Charter Number

Federal I.D. Number

Address

City

State

Zip

Balance Sheet Date

(MM/DD/YYYY)

__ __/__ __/__ __ __ __

r

r

r

Select Applicable Boxes

Consolidated MO Return

Consolidated Federal and Separate Missouri Return

Amended Return

r

r

r

r

r

r

Name Change

Address Change

Final Corporation Income Tax Return

Bankruptcy

1120C

990T

r

r

B. Return filed for both

A. Select this box if your assets in Missouri

(Schedule

MO-FT, Line 6a), or apportioned to Missouri

(income and franchise)

(Schedule MO-FT, Line 6b) do not exceed $10,000,000. You do not owe franchise tax. If your assets

r

C. Return filed for income tax only

do exceed the $10,000,000 threshold, you must complete and attach Schedule MO-FT and enter the

r

franchise tax due on the

Form

MO-1120, Line 16 below. If Box A is checked, Box C cannot be checked.

D. Return filed for franchise tax only

1. Federal Taxable Income from Federal Form 1120, Line 30 ...................................................................................

1

00

2. Corporation income tax from Missouri, or other states, their subdivisions, and

2

00

District of Columbia deducted in determining federal taxable income ..................

3. Missouri modifications - Additions (complete Page 2, Part 1) ...............................

3

00

4. Total additions - Add Lines 2 and 3 ........................................................................................................................

4

00

5. Missouri modifications - Subtractions (complete Page 2, Part 2) ...........................................................................

5

00

6. Balance - Line 1 plus Line 4 less Line 5 .................................................................................................................

6

00

7. Small Business Deduction for New Jobs under

Section 143.173, RSMo

(complete

Form

MO-NJD) .................

7

00

8. Federal Income Tax - current year (complete Page 2, Part 3) ...............................................................................

8

00

9. Missouri Taxable Income - all sources - Line 6 less Line 7 and Line 8 ..................................................................

9

00

10. Missouri Taxable Income - if all Missouri income, repeat Line 9. If not, complete

Schedule MO-MS

and enter

.

apportionment method chosen

and the applicable %

Multiply Line 9 by the percentage .. 10

00

11. Missouri Dividends Deduction (see instructions before entering an amount) ........................................................ 11

00

12. Enterprise Zone or Rural Empowerment Zone Income Modification ..................................................................... 12

00

13. Missouri Taxable Income - Line 10 less Line 11 and Line 12 ................................................................................ 13

00

14. Corporation Income Tax - 6.25% of Line 13 .......................................................................................................... 14

00

15. Recapture of Missouri Low Income Housing Credit (attach a copy of Federal Form 8611) (see instructions) ... 15

00

16. Corporation Franchise Tax (Complete Schedule MO-FT and attach balance sheet) ............................................ 16

00

17. Total Tax - Add Lines 14, 15, and 16 ..................................................................................................................... 17

00

18. Tax credits - (attach

Form

MO-TC) ....................................................................................................................... 18

00

19. Estimated tax payments (include approved overpayments applied from previous year) .......................................... 19

00

20. Payments with

Form MO-7004

.............................................................................................................................. 20

00

21. Amended Return Only: Tax paid with (or after) the filing of the original return ...................................................... 21

00

22. Subtotal - Add Lines 18 through 21 ........................................................................................................................ 22

00

23. Amended Return Only: Overpayment, if any, as shown on original return or as later adjusted ............................. 23

00

24. Total - Line 22 less Line 23 .................................................................................................................................... 24

00

25. If Line 24 is greater than Line 17, enter overpayment here ................................................................................... 25

00

26. Amount remitted or amount

LEAD

Additional

Additional

Missouri

Workers

Missouri

Elderly

Fund Code

Fund Code

National

Workers’

Childhood

of tax overpayment to be

Home

Military

(See Instr.)

(See Instr.)

Memorial

Children’s

Veterans

Guard

Lead Testing

General

After School

Organ Donor

Family

Delivered Meals

______|______

______|______

contributed to the funds

Trust Fund

Trust Fund

Fund

Revenue Fund

Retreat Fund

Program Fund

Fund

Relief Fund

Trust Fund

Trust Fund

listed to the right. ............26.

00

00

00

00

00

00

00

00

00

00

00

00

27. Overpayment to be applied to next filing period ..................................................................................................... 27

00

28. Overpayment to be refunded - Line 25 less Lines 26 and 27 .................................................................... Refund 28

00

29. If Line 24 is less than Line 17, enter underpayment here ...................................................................................... 29

00

30

00

30. Enter total amount on Line 30

Interest

Penalty

Form MO-2220

31. Total Due - Add Lines 29 and 30 (U.S. funds only) ................................................................................ Total Due 31

00

If you pay by check, you authorize the Department of Revenue to process the check electronically. Any returned check may be presented again electronically.

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct.

I authorize the Director of Revenue or delegate to discuss my return and attachments with the preparer or any member

r

r

r

r

r

r

S

E

B

F

of his or her firm, or if internally prepared, any member of the internal staff.

DOR Only

Yes

No

Required - Officer Signature and Printed Name

Title of Officer

Phone Number

Date Signed (MM/DD/YYYY)

(__ __ __) __ __ __ - __ __ __ __

__ __ /__ __ /__ __ __ __

Preparer’s Signature (Including Internal Preparer)

Preparer’s FEIN, SSN, or PTIN

Phone Number

Date Signed (MM/DD/YYYY)

(__ __ __) __ __ __ - __ __ __ __

__ __ /__ __ /__ __ __ __

Form MO-1120 (Revised 05-2014)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2