Instructions For Form Sc1120tc

ADVERTISEMENT

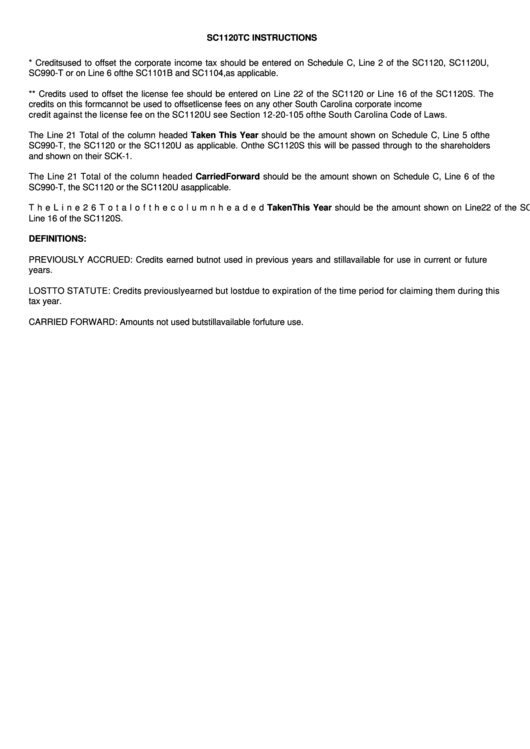

SC1120TC INSTRUCTIONS

* Credits used to offset the corporate income tax should be entered on Schedule C, Line 2 of the SC1120, SC1120U,

SC990-T or on Line 6 of the SC1101B and SC1104, as applicable.

** Credits used to offset the license fee should be entered on Line 22 of the SC1120 or Line 16 of the SC1120S. The

credits on this form cannot be used to offset license fees on any other South Carolina corporate income tax return. For a

credit against the license fee on the SC1120U see Section 12-20-105 of the South Carolina Code of Laws.

The Line 21 Total of the column headed Taken This Year should be the amount shown on Schedule C, Line 5 of the

SC990-T, the SC1120 or the SC1120U as applicable. On the SC1120S this will be passed through to the shareholders

and shown on their SCK-1.

The Line 21 Total of the column headed Carried Forward should be the amount shown on Schedule C, Line 6 of the

SC990-T, the SC1120 or the SC1120U as applicable.

The Line 26 Total of the column headed Taken This Year should be the amount shown on Line 22 of the SC1120 or

Line 16 of the SC1120S.

DEFINITIONS:

PREVIOUSLY ACCRUED: Credits earned but not used in previous years and still available for use in current or future

years.

LOST TO STATUTE: Credits previously earned but lost due to expiration of the time period for claiming them during this

tax year.

CARRIED FORWARD: Amounts not used but still available for future use.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1