JT-1/UC-001 (10/10)

Page 3

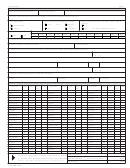

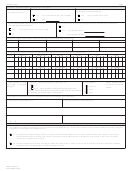

Section D: Withholding/Unemployment Tax Information

1. Date Employees

2. Are you liable for Federal Unemployment Tax?

3. Are individuals performing services that are excluded from

withholding or unemployment tax?

First Hired in Arizona.

*

Yes

If yes, what was the fi rst year of liability?

Yes

If yes, describe the services:

No

Year

No

4. Do you have an IRS Ruling that grants an exclusion

5. Do you have or have you previously had an Arizona Unemployment Tax Number?

from Federal Unemployment Tax?

No

Yes

If yes, attach a copy of the Ruling Letter.

Yes

If yes, Business Name

No

Unemployment Number

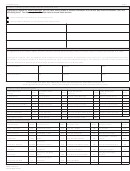

6. Record of Arizona wages paid by calendar quarter for current and preceding calendar year.

YEAR

1ST QUARTER

2ND QUARTER

3RD QUARTER

4TH QUARTER

7. Weekly record of number of persons performing services in Arizona for current and preceding calendar year.

YEAR

JANUARY

FEBRUARY

MARCH

APRIL

MAY

JUNE

YEAR

JULY

AUGUST

SEPTEMBER

OCTOBER

NOVEMBER

DECEMBER

Complete this section if you acquired, or changed the legal form of business of, all or part of an existing Arizona business.

8. Date Acquired or Date

9. Acquired, or Changed Legal Form of Business of,

10. Acquired by

If other, including change

*

*

Legal Form of Business

in legal form of business,

All

Purchase

changed

*

explain:

Part

If part, to obtain an unemployment tax rate based on the

Lease

business’s previous account you must request it no later than 180 days after the

Other

date entered in item 8 of this section. See instructions.

Previous Owner Information or Previous Legal Form of Busness Information (See instructions.)

11. Name(s) of Previous Owner(s)

12. Business Name of Previous Owner(s)

*

*

13. Current Mailing Address of Previous Owner(s) (Street, City, State, ZIP code)

14. Current Telephone Number of Previous Owner(s)

15. Unemployment Account Number of Previous Owner(s)

(

)

Voluntary Election of Unemployment Insurance Coverage (subject to Unemployment Tax Offi ce approval).

16. The applicant, on behalf of the employing unit, voluntarily elects beginning January 1 of the current calendar year or the date employment started, if later, and

continuing for not less than two calendar years, to:

A. Be deemed an employer subject to Title 23, Chapter 4, Arizona Revised Statutes, to the same extent as all other such employers and provide

unemployment insurance coverage to my workers performing services defi ned by law as employment, even though I have not met conditions

requiring me to provide such coverage.

B. Extend unemployment insurance coverage to workers referred to in item 2, above, by having the services they perform be deemed to constitute.

Employment by an employer subject to Title 23, Chapter 4, A.R.S.

ADOR 10194 (10/10)

Previous ADOR 74-4002

1

1 2

2 3

3 4

4