JT-1/UC-001 (10/10)

Page 4

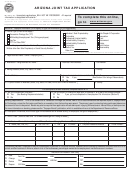

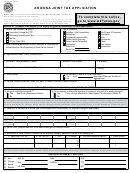

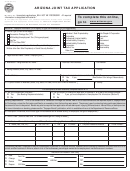

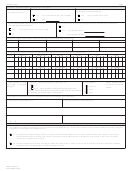

Section E: AZTaxes.gov Security Administrator (Authorized User)

By electing to register for you can have online access to account information, and fi le and pay Arizona transaction, use, and

withholding taxes. You also designate authorized users to access these services.

I Elect to Register to use aztaxes.gov to fi le and pay online.

I DO NOT Elect to Register to use aztaxes.gov to fi le and pay online.

1. Authorized Users Last Name

2. Authorized Users First Name

3. Authorized Users Title

4. Authorized Users Social Security Number

5. Authorized Users Email Address

6. Authorized Users Phone Number

Section F: Signature(s) by individuals legally responsible for the business (required)

This application must be signed by either a sole owner, partners, corporate offi cer, managing member, the trustee, receiver or personal representative of an estate.

Under penalty of perjury I (we), the applicant, declare that the information provided on this application is true and correct. I (we) hereby authorize the security

administrator, if one is listed in Section E, to access the AZTaxes.gov site for the business identifi ed in Section A. This authority is to remain in full force and effect until

the Arizona Department of Revenue has received written termination notifi cation from an authorized offi cer.

Type or Print Name

Title

Signature

Date

Type or Print Name

Title

Signature

Date

THIS APPLICATION MUST BE COMPLETED, SIGNED AND RETURNED AS PROVIDED BY ARS § 23-722

Equal Opportunity Employer/Program This document available in alternative formats by contacting the UI Tax Offi ce.

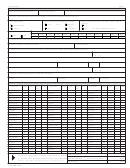

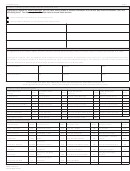

Section G: Indian Reservation Codes

Indian Reservation

Indian Reservation

Indian Reservation

Indian Reservation

Code

Code

Code

Code

(County)

(County)

(County)

(County)

Ak-Chin (Pinal)

PNA

Hopi (Coconino)

COJ

Pascua-Yaqui (Maricopa)

MAN

Tohono O’dham (Pinal)

PNT

Cocopah (Yuma)

YMB

Hopi (Navajo)

NAJ

Pascua-Yaqui (Pima)

PMN

Tonto Apache (Gila)

GLU

Colorado River (La Paz)

LAC

Hualapai (Coconino)

COK Salt River Pima-Maricopa (Mar.)

MAO White Mtn Apache (Apache)

APD

Fort McDowell-Yavapai (Mar.)

MAE

Hualapai (Mohave)

MOK San Carlos Apache (Gila)

GLP

White Mtn Apache (Gila)

GLD

Fort Mohave (Mohave)

MOF

Kaibab-Paiute (Coconino)

COL

San Carlos Apache (Graham)

GRP

White Mtn Apache (Graham)

GRD

Fort Yuma-Quechan (Yuma)

YMG Kaibab-Paiute (Mohave)

MOL San Carlos Apache (Pinal)

PNP

White Mtn Apache (Navajo)

NAD

Gila River (Maricopa)

MAH

Navajo (Apache)

APM San Juan Southern Paiute (Coco.) COQ Yavapai Apache (Yavapai)

YAW

Gila River (Pinal)

PNH

Navajo (Coconino)

COM Tohono O’Odham (Maricopa)

MAT

Yavapai Prescott (Yavapai)

YAX

Havasupai (Coconino)

COI

Navajo (Navajo)

NAM Tohono O’Odham (Pima)

PMT

Section H: Business Classes

Business Class

Code

Business Class

Code

Business Class

Code

Business Class

Code

Mining - Nonmetal

002

Commercial Lease

013

Use Tax - Utilities

026

Jet Fuel Tax

049

Utilities

004

Personal Property Rental

014

Rental Occupancy Tax

028

Jet Fuel Use Tax

051

Communications

005

Contracting - Prime

015

Use Tax Purchases

029

Rental Car Surcharge

053/055

Jet Fuel Tax > 10 million

Transporting

006

Retail

017

Use Tax from Inventory

030

gallons

056

Severance -

Private Car - Pipeline

007/008 Metalliferous Mining

019

Telecommunications Devices

033

Use Tax Direct Payments

129

Severance - Timbering

911 Wireless

911 Wireline

Publication

009

Ponderosa

021

Telecommunications

036

Telecommunications

131

Severance - Timbering

Rental Car Surcharge -

Job Printing

010

Other

022

Contracting - Owner Builder

037

Stadium

153

Recreational Vehicle

Restaurants and Bars

011

Surcharge

023

Municipal Water

041

Amusement

012

Transient Lodging

025

Membership Camping

047

ADOR 10194 (10/10)

Previous ADOR 74-4002

1

1 2

2 3

3 4

4