Publication 971 (Rev. April 2008) - Innocent Spouse Relief Page 10

ADVERTISEMENT

The amount of the refund is subject to the limit dis-

3. Janie believes she meets the third condition. She

cussed later under Limit on Amount of Refund.

believes it would be unfair to be held liable for the tax

because she did not benefit from the award. Joe

spent it on personal items for his use only.

Understated tax. If you are granted relief for an under-

stated tax, you are eligible for a refund of certain payments

Because Janie believes she qualifies for innocent spouse

made under an installment agreement that you entered

relief, she first completes Part I of Form 8857 to determine

into with the IRS, if you have not defaulted on the install-

if she should file the form. In Part I, she makes all entries

ment agreement. You are not in default if the IRS did not

under the Tax Year 1 column because she is requesting

issue you a notice of default or take any action to end the

relief for only one year.

installment agreement. Only installment payments made

Part I

after the date you filed Form 8857 are eligible for a refund.

Line 1. She enters “2004” on line 1 because this is the tax

The amount of the refund is subject to the limit dis-

year for which she is requesting relief.

cussed next.

Line 2. She checks the box because she wants a refund.

Limit on Amount of Refund

Note. Because the IRS used her individual refund to

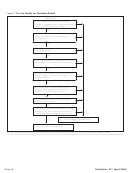

The amount of your refund is limited. Read the following

pay the tax owed on the joint tax return, she does not need

chart to find out the limit.

to provide proof of payment.

If you file Form 8857...

THEN the refund cannot be

Line 3. She checks the “No” box because the IRS did not

more than...

use her share of a joint refund to pay Joe’s past-due debts.

Within 3 years after filing your

The part of the tax paid within 3

Line 4. She checks the “Yes” box because she filed a joint

return

years (plus any extension of time

tax return for tax year 2004.

for filing your return) before you

file Form 8857.

Line 5. She skips this line because she checked the “Yes”

After the 3-year period, but within The tax you paid within 2 years

box on line 4.

2 years from the time you paid

immediately before you filed

the tax

Form 8857.

Part II

Line 6. She enters her name, address, social security

number, county, and best daytime phone number.

Filled-in Form 8857

Part III

Line 7. She enters Joe’s name, address, social security

This part explains how Janie Boulder fills out Form 8857 to

number, and best daytime phone number.

request innocent spouse relief.

Line 8. She checks the “divorced since” box and enters

the date she was divorced as “05/13/2006.” She attaches a

Janie and Joe Boulder filed a joint tax return for 2004.

copy of her entire divorce decree (not Illustrated) to the

They claimed one dependency exemption for their son

form.

Michael. Their return was adjusted by the IRS because Joe

did not report a $5,000 award he won that year. Janie did

Line 9. She checks the box for “High school diploma,

not know about the award when the return was filed. They

equivalent, or less,” because she had completed high

agreed to the adjustment but could not pay the additional

school when her 2004 joint tax return was filed.

amount due of $815 ($650 tax + $165 penalty and inter-

Line 10. She checks the “No” box because she was not a

est). Janie and Joe were divorced on May 13, 2006. In

victim of spousal abuse or domestic violence.

February 2007, Janie filed her 2006 federal income tax

return as head of household. She expected a refund of

Line 11. She checks the “Yes” box because she signed

$1,203. In May 2007, she received a notice informing her

the 2004 joint tax return.

that the IRS had offset her refund against the $815 owed

Line 12. She checks the “No” box because she did not

on her joint 2004 income tax return and that she had a right

have a mental or physical condition when the return was

to file Form 8857.

filed and does not have one now.

Janie applies the conditions listed earlier under Inno-

cent Spouse Relief to see if she qualifies for relief.

Part IV

1. Janie meets the first condition because the joint tax

Line 13. Because she was not involved in preparing the

return they filed has an understated tax due to Joe’s

return, she checks the box, “You were not involved in

erroneous item.

preparing the returns.”

2. Janie believes she meets the second condition. She

Line 14. She checks the box, “You did not know anything

did not know about the award and had no reason to

was incorrect or missing” because she did not know that

know about it because of the secretive way Joe con-

Joe had received a $5,000 award. She explains this in the

ducted his financial affairs.

space provided.

Page 10

Publication 971 (April 2008)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23