Publication 971 (Rev. April 2008) - Innocent Spouse Relief Page 17

ADVERTISEMENT

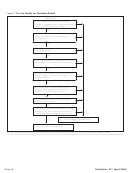

Figure B. Do You Qualify for Separation of Liability Relief?

Start Here

No

You do not qualify for separation of

Did you file a joint return for the year you want

liability relief but you may qualify for

relief?

relief from liability arising from

community property law. See

Yes

Community Property Laws earlier.

No

Does your joint return have an understated tax?

Yes

Are you still married to the spouse with whom

you filed the joint return? (If that spouse is

No

deceased, answer “No.”)

Yes

Yes

Are you legally separated from the spouse with

whom you filed the joint return?

No

Yes

Were you a member of the same household as

the spouse with whom you filed the joint return

at any time during the 12-month period ending

on the date you file Form 8857?

No

You do not qualify for separation of liability

relief; go to Figure C.

You may qualify for separation of liability relief.

Publication 971 (April 2008)

Page 17

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23