Publication 971 (Rev. April 2008) - Innocent Spouse Relief Page 18

ADVERTISEMENT

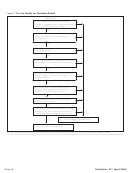

Figure C. Do You Qualify for Equitable Relief?

Start Here

Are you eligible for innocent spouse relief,

Yes

separation of liability relief, or relief from liability

arising from community property law?

No

No

Does your return have an understated or

underpaid tax?

Yes

1

Yes

Did you pay the tax?

No

Are you able to show it would be unfair to hold

No

you liable for the understated or underpaid tax?

Yes

Did you and your spouse (or former spouse)

Yes

transfer property to one another as part of a

fraudulent scheme?

No

Did your spouse (or former spouse) transfer

Yes

property to you for the main purpose of

avoiding tax or the payment of tax?

No

Yes

Did you file or fail to file your return with the

intent to commit fraud?

No

Is the income tax liability from which you seek

2

No

relief due to an item of the spouse (or former

spouse) with whom you filed the joint return?

Yes

You do not qualify for equitable relief.

You may qualify for equitable relief.

1

You may qualify for equitable relief and receive a refund of certain payments made out of your own funds. See Refunds earlier.

2

You may qualify for equitable relief if you meet any of the exceptions to condition (8) discussed earlier under Conditions for Getting Equitable Relief.

Page 18

Publication 971 (April 2008)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23