Publication 54 - Tax Guide For U.s. Citizens And Resident Aliens Abord - 2011 Page 25

ADVERTISEMENT

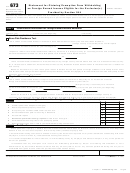

2555

OMB No. 1545-0074

Foreign Earned Income

2011

Form

See separate instructions.

Attach to Form 1040.

Attachment

Department of the Treasury

▶

▶

34

Sequence No.

Internal Revenue Service

For Use by U.S. Citizens and Resident Aliens Only

Name shown on Form 1040

Your social security number

111-00-1111

James M. Adams

General Information

Part I

1

2

Your foreign address (including country)

Your occupation

10 North Avenue, City A, Country X

Engineer

Pan American Oil Company

3

Employer’s name

▶

N/A

4 a Employer’s U.S. address

▶

65 South Avenue, City A, Country X

b Employer’s foreign address

▶

X

a

A foreign entity

b

A U.S. company

c

Self

5

Employer is (check

any that apply):

d

A foreign af liate of a U.S. company

e

Other (specify)

▶

2010

6 a If, after 1981, you led Form 2555 or Form 2555-EZ, enter the last year you led the form.

▶

b If you did not le Form 2555 or 2555-EZ after 1981 to claim either of the exclusions, check here

and go to line 7.

▶

c Have you ever revoked either of the exclusions? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

d If you answered “Yes,” enter the type of exclusion and the tax year for which the revocation was effective.

▶

United States

7

Of what country are you a citizen/national?

▶

8 a Did you maintain a separate foreign residence for your family because of adverse living conditions at your

tax home? See Second foreign household in the instructions

Yes

No

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

b If “Yes,” enter city and country of the separate foreign residence. Also, enter the number of days during your tax year that you

City Y, Country Y 365 days

maintained a second household at that address.

▶

City A, Country X 6-9-2008

9

List your tax home(s) during your tax year and date(s) established.

▶

Next, complete either Part II or Part III. If an item does not apply, enter “NA.” If you do not give

the information asked for, any exclusion or deduction you claim may be disallowed.

Taxpayers Qualifying Under Bona Fide Residence Test (see instructions)

Part II

10

Date bona de residence began

, and ended

▶

▶

11

a

b

c

Kind of living quarters in foreign country

Purchased house

Rented house or apartment

Rented room

▶

d

Quarters furnished by employer

12a Did any of your family live with you abroad during any part of the tax year? .

Yes

No

.

.

.

.

.

.

.

.

.

.

b If “Yes,” who and for what period?

▶

13 a Have you submitted a statement to the authorities of the foreign country where you claim bona de

residence that you are not a resident of that country? See instructions

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

b Are you required to pay income tax to the country where you claim bona de residence? See instructions .

Yes

No

If you answered “Yes” to 13a and “No” to 13b, you do not qualify as a bona fide resident. Do not complete the rest of

this part.

If you were present in the United States or its possessions during the tax year, complete columns (a)–(d) below. Do not

14

include the income from column (d) in Part IV, but report it on Form 1040.

(c) Number of

(d) Income earned in

(c) Number of

(d) Income earned in

(a) Date

(b) Date left

(a) Date

(b) Date left

days in U.S.

U.S. on business

days in U.S. on

U.S. on business

arrived in U.S.

U.S.

arrived in U.S.

U.S.

on business

(attach computation)

business

(attach computation)

15a List any contractual terms or other conditions relating to the length of your employment abroad.

▶

b Enter the type of visa under which you entered the foreign country.

▶

c Did your visa limit the length of your stay or employment in a foreign country? If “Yes,” attach explanation .

Yes

No

d Did you maintain a home in the United States while living abroad? .

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

e If “Yes,” enter address of your home, whether it was rented, the names of the occupants, and their relationship

to you.

▶

2555

For Paperwork Reduction Act Notice, see the Form 1040 instructions.

Form

(2011)

Cat. No. 11900P

Chapter 4 Foreign Earned Income and Housing: Exclusion – Deduction

Page 25

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44