Publication 54 - Tax Guide For U.s. Citizens And Resident Aliens Abord - 2011 Page 27

ADVERTISEMENT

3

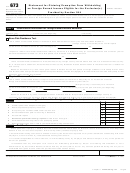

Form 2555 (2011)

Page

Part V

All Taxpayers

100,000

27

Enter the amount from line 26 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

27

Are you claiming the housing exclusion or housing deduction?

Yes. Complete Part VI.

No. Go to Part VII.

Taxpayers Claiming the Housing Exclusion and/or Deduction

Part VI

31,000

28

Quali ed housing expenses for the tax year (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

28

29a

Enter location where housing expenses incurred (see instructions)

▶

27,870

b Enter limit on housing expenses (see instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

29b

27,870

30

Enter the smaller of line 28 or line 29b .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

30

31

Number of days in your qualifying period that fall within your 2011 tax

365

year (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

31

days

14,864

32

32

Multiply $40.72 by the number of days on line 31. If 365 is entered on line 31, enter $14,864.00 here

33

Subtract line 32 from line 30. If the result is zero or less, do not complete the rest of this part or

13,006

any of Part IX

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

33

100,000

34

Enter employer-provided amounts (see instructions) .

.

.

.

.

.

34

35

Divide line 34 by line 27. Enter the result as a decimal (rounded to at least three places), but do

.

×

1 000

35

not enter more than “1.000” .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

36

Housing exclusion. Multiply line 33 by line 35. Enter the result but do not enter more than the

13,006

amount on line 34. Also, complete Part VIII .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

36

▶

Note: The housing deduction is figured in Part IX. If you choose to claim the foreign earned

income exclusion, complete Parts VII and VIII before Part IX.

Taxpayers Claiming the Foreign Earned Income Exclusion

Part VII

37

Maximum foreign earned income exclusion

. . . . . . . . . . . . . . . . . . . . .

37

92,900

}

38

• If you completed Part VI, enter the number from line 31.

38

365

days

• All others, enter the number of days in your qualifying period that

fall within your 2011 tax year (see the instructions for line 31).

39

• If line 38 and the number of days in your 2011 tax year (usually 365) are the same, enter “1.000.”

}

.

×

1 000

39

• Otherwise, divide line 38 by the number of days in your 2011 tax year and enter the result as

a decimal (rounded to at least three places).

40

40

92,900

Multiply line 37 by line 39

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

41

Subtract line 36 from line 27

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

41

86,994

Foreign earned income exclusion. Enter the smaller of line 40 or line 41. Also, complete Part VIII

42

42

86,994

▶

Taxpayers Claiming the Housing Exclusion, Foreign Earned Income Exclusion, or Both

Part VIII

43

43

100,000

Add lines 36 and 42

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

44

Deductions allowed in guring your adjusted gross income (Form 1040, line 37) that are allocable

to the excluded income. See instructions and attach computation .

.

.

.

.

.

.

.

.

.

44

45

Subtract line 44 from line 43. Enter the result here and in parentheses on Form 1040, line 21.

Next to the amount enter “Form 2555.” On Form 1040, subtract this amount from your income

100,000

45

to arrive at total income on Form 1040, line 22

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Taxpayers Claiming the Housing Deduction— Complete this part only if (a) line 33 is more than line 36 and

Part IX

(b) line 27 is more than line 43.

46

Subtract line 36 from line 33

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

46

47

47

Subtract line 43 from line 27

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

48

Enter the smaller of line 46 or line 47

48

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Note: If line 47 is more than line 48 and you could not deduct all of your 2010 housing deduction

because of the 2010 limit, use the worksheet on page 4 of the instructions to figure the amount

to enter on line 49. Otherwise, go to line 50.

49

49

Housing deduction carryover from 2010 (from worksheet on page 4 of the instructions) .

.

.

50

Housing deduction. Add lines 48 and 49. Enter the total here and on Form 1040 to the left of

line 36. Next to the amount on Form 1040, enter “Form 2555.” Add it to the total adjustments

reported on that line

50

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

2555

Form

(2011)

Chapter 4 Foreign Earned Income and Housing: Exclusion – Deduction

Page 27

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44