Section II.

Election Information

1.

Pursuant to section 3(b)(1) and section 3(c)(2) of Announcement 2005-19, the Corporation elects to claim the allowable

compensation deduction in its taxable year that includes

:

("X" only one)

a.

the date

the stock options were transferred to the Related Person, or

(s)

b.

the date

the options were exercised or the restricted stock vested, or

(s)

c.

December 31, 2004, or

d.

December 31 of the year in which the Executive recognizes the compensation, or

e.

December 31 of the year determined under IRC section 3(c)(2) of Announcement 2005-19.

2.

Did the Corporation already claim a compensation deduction for

stock options or restricted stock that its Executives transferred

any

in Notice 2003-47 transactions?

Yes

No

(See instructions below.)

If "Yes," please attach a schedule listing the amounts and years of such deductions.

3.

Did the Corporation already claim

deductions for transaction costs

any

(i.e., fees paid to promoters, attorneys, accountants,

concerning Notice 2003-47 transactions?

appraisers, or others)

Yes

No

(See instructions below.)

If "Yes", please attach a schedule listing the amounts and years of such deductions. If the Corporation wishes to claim deductions

for such costs that have not been previously deducted, also attach a schedule\ listing the amounts and years of such fees and

attach documents substantiating payment.

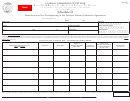

Section III.

Executive Information

For each Executive

who participated in a Notice 2003-47 transaction using either stock

(Officer, Director, employee)

options granted or restricted stock issued by the Corporation, please provide the following information. If you need

additional space for your answers, please attach additional sheets and identify the continued answers by item number.

1.

Name and address

of Executive

2.

Executive identification

(Street, City, State, ZIP code)

number

(SSN)

3.

Name and address

of Related Person to which the Executive

4.

Related Person identification

(Street, City, State, ZIP code)

transferred the options or stock

number

(EIN)

5.

Date

Executive transferred options or restricted stock to

6.

Date

such options were exercised or date

such

(s)

(s)

(s)

Related Person

restricted stock vested

7.

Was a Form 1099 or Form W-2 issued to the Executive upon the Executive's transfer of the options or the restricted stock to the

Related Person?

Yes

No

(See instructions below.)

If "Yes," please attach copies of the form and specify the amount representing the option or restricted stock value

included on the Form 1099 or Form W-2.

8.

Was a Form 1099 or Form W-2 issued to the Executive upon the exercise of the options or the vesting of the restricted stock?

Yes

No

(See instructions below.)

If "Yes," please attach copies of the form and specify the amount representing the option or restricted stock value included on the

Form 1099 or Form W-2.

13657

Sheet 2 of 3

Department of the Treasury – Internal Revenue Service

Form

(3-2005)

Catalog No. 39566V

1

1 2

2 3

3