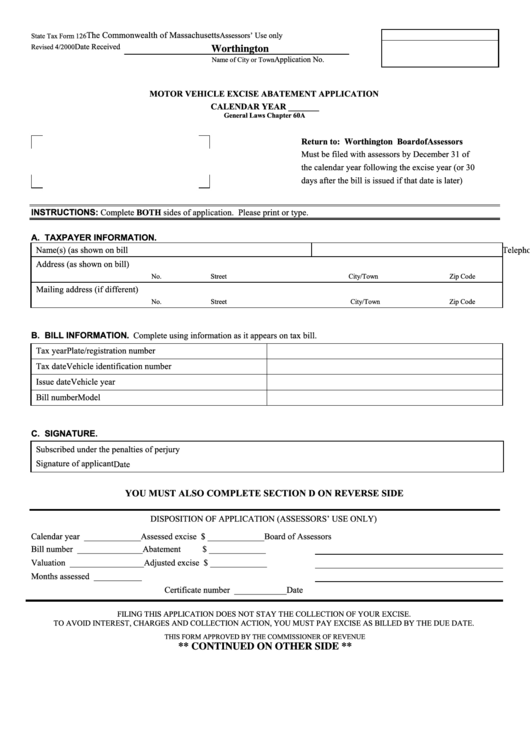

Form 126 - Motor Vehicle Excise Abatement Application - The Commonwealth Of Massachusetts - Worthington Board Of Assessors

ADVERTISEMENT

The Commonwealth of Massachusetts

Assessors’ Use only

State Tax Form 126

Date Received

Revised 4/2000

Worthington

Application No.

Name of City or Town

MOTOR VEHICLE EXCISE ABATEMENT APPLICATION

CALENDAR YEAR _______

General Laws Chapter 60A

Return to: Worthington Board of Assessors

Must be filed with assessors by December 31 of

the calendar year following the excise year (or 30

days after the bill is issued if that date is later)

INSTRUCTIONS: Complete BOTH sides of application. Please print or type.

A. TAXPAYER INFORMATION.

Name(s) (as shown on bill

Telephone No. (

)

Address (as shown on bill)

No.

Street

City/Town

Zip Code

Mailing address (if different)

No.

Street

City/Town

Zip Code

B. BILL INFORMATION. Complete using information as it appears on tax bill.

Tax year

Plate/registration number

Tax date

Vehicle identification number

Issue date

Vehicle year

Bill number

Model

C. SIGNATURE.

Subscribed under the penalties of perjury

Signature of applicant

Date

YOU MUST ALSO COMPLETE SECTION D ON REVERSE SIDE

DISPOSITION OF APPLICATION (ASSESSORS’ USE ONLY)

Calendar year _____________

Assessed excise $ _____________

Board of Assessors

Bill number _______________

Abatement

$ _____________

Valuation _________________

Adjusted excise $ _____________

Months assessed ___________

Certificate number ____________

Date

FILING THIS APPLICATION DOES NOT STAY THE COLLECTION OF YOUR EXCISE.

TO AVOID INTEREST, CHARGES AND COLLECTION ACTION, YOU MUST PAY EXCISE AS BILLED BY THE DUE DATE.

THIS FORM APPROVED BY THE COMMISSIONER OF REVENUE

** CONTINUED ON OTHER SIDE **

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2