Form Ct-47 - Claim For Farmers' School Tax Credit - New York State Department Of Taxation And Finance - 2011

ADVERTISEMENT

Staple forms here

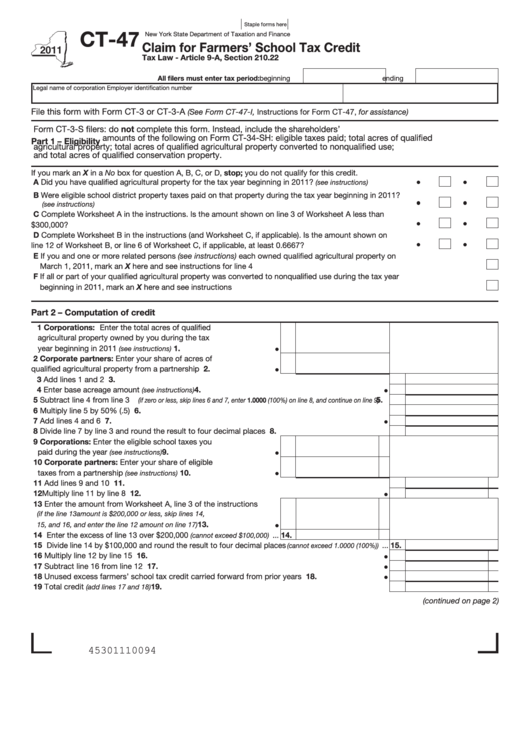

CT-47

New York State Department of Taxation and Finance

Claim for Farmers’ School Tax Credit

Tax Law - Article 9-A, Section 210.22

All filers must enter tax period:

beginning

ending

Legal name of corporation

Employer identification number

File this form with Form CT-3 or CT-3-A

(See Form CT-47-I, Instructions for Form CT-47, for assistance)

Form CT-3-S filers: do not complete this form. Instead, include the shareholders’

amounts of the following on Form CT-34-SH: eligible taxes paid; total acres of qualified

Part 1 – Eligibility

agricultural property; total acres of qualified agricultural property converted to nonqualified use;

and total acres of qualified conservation property.

If you mark an X in a No box for question A, B, C, or D, stop; you do not qualify for this credit.

A Did you have qualified agricultural property for the tax year beginning in 2011?

.................

Yes

No

(see instructions)

B Were eligible school district property taxes paid on that property during the tax year beginning in 2011?

............................................................................................................................................

Yes

No

(see instructions)

C Complete Worksheet A in the instructions. Is the amount shown on line 3 of Worksheet A less than

$300,000? ...................................................................................................................................................

Yes

No

D Complete Worksheet B in the instructions (and Worksheet C, if applicable). Is the amount shown on

line 12 of Worksheet B, or line 6 of Worksheet C, if applicable, at least 0.6667? .......................................

Yes

No

E If you and one or more related persons (see instructions) each owned qualified agricultural property on

March 1, 2011, mark an X here and see instructions for line 4 ....................................................................................................

F If all or part of your qualified agricultural property was converted to nonqualified use during the tax year

beginning in 2011, mark an X here and see instructions .............................................................................................................

Part 2 – Computation of credit

1 Corporations: Enter the total acres of qualified

agricultural property owned by you during the tax

1.

year beginning in 2011

.......................................

(see instructions)

2 Corporate partners: Enter your share of acres of

qualified agricultural property from a partnership ......................

2.

3 Add lines 1 and 2 ................................................................................................................................

3.

4 Enter base acreage amount

.....................................................................................

4.

(see instructions)

5 Subtract line 4 from line 3

....

5.

(if zero or less, skip lines 6 and 7, enter 1.0000 (100%) on line 8, and continue on line 9)

6 Multiply line 5 by 50% (.5) ...................................................................................................................

6.

7 Add lines 4 and 6 ..............................................................................................................................

7.

8 Divide line 7 by line 3 and round the result to four decimal places ....................................................

8.

9 Corporations: Enter the eligible school taxes you

paid during the year

...........................................

9.

(see instructions)

10 Corporate partners: Enter your share of eligible

10.

taxes from a partnership

....................................

(see instructions)

11 Add lines 9 and 10 .............................................................................................................................. 11.

12 Multiply line 11 by line 8 ....................................................................................................................

12.

13 Enter the amount from Worksheet A, line 3 of the instructions

(if the line 13 amount is $200,000 or less, skip lines 14,

13.

...........................

15, and 16, and enter the line 12 amount on line 17)

14 Enter the excess of line 13 over $200,000

... 14.

(cannot exceed $100,000)

15 Divide line 14 by $100,000 and round the result to four decimal places

... 15.

(cannot exceed 1.0000 (100%))

16 Multiply line 12 by line 15 ..................................................................................................................

16.

17 Subtract line 16 from line 12 .............................................................................................................

17.

18 Unused excess farmers’ school tax credit carried forward from prior years ....................................

18.

19 Total credit

............................................................................................................ 19.

(add lines 17 and 18)

(continued on page 2)

45301110094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2