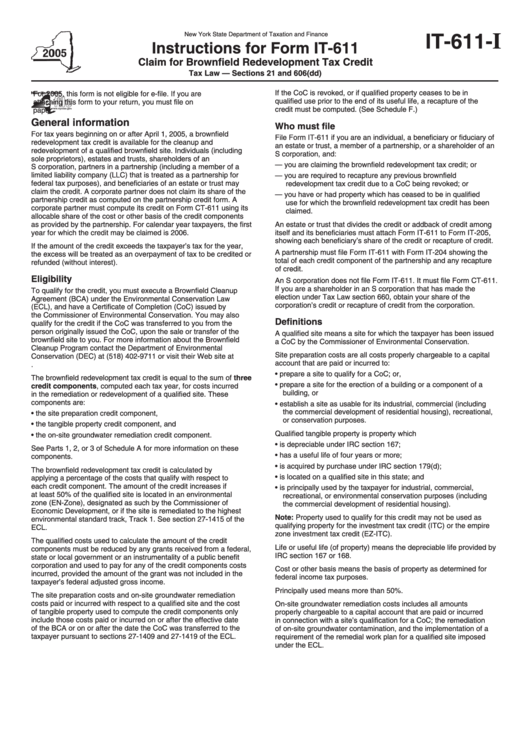

Instructions For Form It-611 - Claim For Brownfield Redevelopment Tax Credit - New York State Department Of Taxation And Finance - 2005

ADVERTISEMENT

I

IT-611-

New York State Department of Taxation and Finance

Instructions for Form IT-611

Claim for Brownfield Redevelopment Tax Credit

Tax Law — Sections 21 and 606(dd)

If the CoC is revoked, or if qualified property ceases to be in

For 2005, this form is not eligible for e-file. If you are

qualified use prior to the end of its useful life, a recapture of the

attaching this form to your return, you must file on

credit must be computed. (See Schedule F.)

paper.

General information

Who must file

For tax years beginning on or after April 1, 2005, a brownfield

File Form IT-611 if you are an individual, a beneficiary or fiduciary of

redevelopment tax credit is available for the cleanup and

an estate or trust, a member of a partnership, or a shareholder of an

redevelopment of a qualified brownfield site. Individuals (including

S corporation, and:

sole proprietors), estates and trusts, shareholders of an

— you are claiming the brownfield redevelopment tax credit; or

S corporation, partners in a partnership (including a member of a

limited liability company (LLC) that is treated as a partnership for

— you are required to recapture any previous brownfield

federal tax purposes), and beneficiaries of an estate or trust may

redevelopment tax credit due to a CoC being revoked; or

claim the credit. A corporate partner does not claim its share of the

— you have or had property which has ceased to be in qualified

partnership credit as computed on the partnership credit form. A

use for which the brownfield redevelopment tax credit has been

corporate partner must compute its credit on Form CT-611 using its

claimed.

allocable share of the cost or other basis of the credit components

as provided by the partnership. For calendar year taxpayers, the first

An estate or trust that divides the credit or addback of credit among

year for which the credit may be claimed is 2006.

itself and its beneficiaries must attach Form IT-611 to Form IT-205,

showing each beneficiary’s share of the credit or recapture of credit.

If the amount of the credit exceeds the taxpayer’s tax for the year,

A partnership must file Form IT-611 with Form IT-204 showing the

the excess will be treated as an overpayment of tax to be credited or

total of each credit component of the partnership and any recapture

refunded (without interest).

of credit.

Eligibility

An S corporation does not file Form IT-611. It must file Form CT-611.

If you are a shareholder in an S corporation that has made the

To qualify for the credit, you must execute a Brownfield Cleanup

election under Tax Law section 660, obtain your share of the

Agreement (BCA) under the Environmental Conservation Law

corporation’s credit or recapture of credit from the corporation.

(ECL), and have a Certificate of Completion (CoC) issued by

the Commissioner of Environmental Conservation. You may also

Definitions

qualify for the credit if the CoC was transferred to you from the

person originally issued the CoC, upon the sale or transfer of the

A qualified site means a site for which the taxpayer has been issued

brownfield site to you. For more information about the Brownfield

a CoC by the Commissioner of Environmental Conservation.

Cleanup Program contact the Department of Environmental

Site preparation costs are all costs properly chargeable to a capital

Conservation (DEC) at (518) 402-9711 or visit their Web site at

account that are paid or incurred to:

• prepare a site to qualify for a CoC; or,

The brownfield redevelopment tax credit is equal to the sum of three

• prepare a site for the erection of a building or a component of a

credit components, computed each tax year, for costs incurred

building, or

in the remediation or redevelopment of a qualified site. These

components are:

• establish a site as usable for its industrial, commercial (including

the commercial development of residential housing), recreational,

• the site preparation credit component,

or conservation purposes.

• the tangible property credit component, and

Qualified tangible property is property which

• the on-site groundwater remediation credit component.

• is depreciable under IRC section 167;

See Parts 1, 2, or 3 of Schedule A for more information on these

• has a useful life of four years or more;

components.

• is acquired by purchase under IRC section 179(d);

The brownfield redevelopment tax credit is calculated by

• is located on a qualified site in this state; and

applying a percentage of the costs that qualify with respect to

each credit component. The amount of the credit increases if

• is principally used by the taxpayer for industrial, commercial,

at least 50% of the qualified site is located in an environmental

recreational, or environmental conservation purposes (including

zone (EN-Zone), designated as such by the Commissioner of

the commercial development of residential housing).

Economic Development, or if the site is remediated to the highest

Note: Property used to qualify for this credit may not be used as

environmental standard track, Track 1. See section 27-1415 of the

qualifying property for the investment tax credit (ITC) or the empire

ECL.

zone investment tax credit (EZ-ITC).

The qualified costs used to calculate the amount of the credit

Life or useful life (of property) means the depreciable life provided by

components must be reduced by any grants received from a federal,

IRC section 167 or 168.

state or local government or an instrumentality of a public benefit

corporation and used to pay for any of the credit components costs

Cost or other basis means the basis of property as determined for

incurred, provided the amount of the grant was not included in the

federal income tax purposes.

taxpayer’s federal adjusted gross income.

Principally used means more than 50%.

The site preparation costs and on-site groundwater remediation

costs paid or incurred with respect to a qualified site and the cost

On-site groundwater remediation costs includes all amounts

of tangible property used to compute the credit components only

properly chargeable to a capital account that are paid or incurred

include those costs paid or incurred on or after the effective date

in connection with a site’s qualification for a CoC; the remediation

of the BCA or on or after the date the CoC was transferred to the

of on-site groundwater contamination, and the implementation of a

taxpayer pursuant to sections 27-1409 and 27-1419 of the ECL.

requirement of the remedial work plan for a qualified site imposed

under the ECL.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3