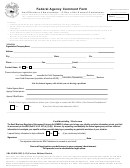

SBA 7(a) Borrower Information Form

OMB Control No.: 3245-0348

(Section I: Applicant Business Information)

Expiration Date: 07/31/2020

Applicant Business Legal Name ( OC / EPC)

DBA or Tradename if applicable

Applicant Business Primary Business Address

Applicant Business Tax ID

Applicant Business Phone

(

)

-

Project Address (if other than primary business address)

Primary Contact

Email Address

# of existing employees employed by business? (including owners):

Amount of Loan Request:

$

# of jobs to be created as a result of the loan? (including owners):

# of jobs that will be retained as a result of the loan that otherwise would have been lost? (including owners):

Purpose of the loan:

Small Business Applicant Ownership

List all proprietors, partners, officers, directors, and holders of outstanding stock. 100% of ownership must be reflected. Attach a separate sheet if

necessary. Based on this form’s instructions not all owners will need to complete the Principal Information section of this form.

Owner Name

Title

Ownership %

Address

Unless stated otherwise, if any of the questions below are answered “Yes,” please provide details on a separate sheet.

#

Question

Yes

No

1

Are there co-applicants? (If “Yes,” please complete a separate Section I: Applicant Business Information for each.)

2

Has an application for the requested loan ever been submitted to the SBA, a lender, or a Certified Development Company, in

connection with any SBA program? (If “Yes,” provide details.)

3

Is the Small Business Applicant presently suspended, debarred, proposed for debarment, declared ineligible, or voluntarily

excluded from participation in this transaction by any Federal department or agency?

4

Does the Small Business Applicant operate under a Franchise/License/Distributor/Membership/Dealer/

Jobber or other type of Agreement? (If “Yes,” provide copies of your agreement(s) and any other relevant documents.)

5

Does the Small Business Applicant have any Affiliates? (If “Yes,” please attach a listing of all Affiliates.)

6

Has the Small Business Applicant and/or its Affiliates ever filed for bankruptcy protection?

7

Is the Small Business Applicant and/or its Affiliates presently involved in any pending legal action?

8

Has the Small Business Applicant and/or its Affiliates ever obtained a direct or guaranteed loan from SBA or any other Federal

agency or been a guarantor on such a loan?

a)

If you answered “Yes” to Question 8, is any of the financing currently delinquent?

b)

If you answered “Yes” to Question 8, did any of this financing ever default and cause a loss to the Government?

9

Are any of the Small Business Applicant’s products and/or services exported or is there a plan to begin exporting as a result of

this loan?

If ”Yes,” provide the estimated total export sales this loan will support:

$

10 Is the Small Business Applicant using (or intending to use) a packager, broker, accountant, lawyer, etc. to assist in (a) preparing

the loan application or any related materials and/or (b) referring the loan to the lender?

11 Are any of the Small Business Applicant’s revenues derived from gambling, loan packaging, or from the sale of products or

services, or the presentation of any depiction, displays or live performances, of a prurient sexual nature?

SBA Form 1919 (05/17)

2

1

1 2

2 3

3 4

4 5

5 6

6 7

7