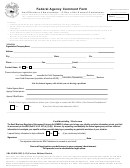

SBA 7(a) Borrower Information Form

OMB Control No.: 3245-0348

Statements Required by Law and Executive Order

Expiration Date: 07/31/2020

Please read the following notices regarding use of federal financial assistance programs and then sign and date the certification.

SBA is required to withhold or limit financial assistance, to impose special conditions on approved loans, to provide special notices to applicants or

borrowers and to require special reports and data from borrowers in order to comply with legislation passed by the Congress and Executive Orders

issued by the President and by the provisions of various inter-agency agreements. SBA has issued regulations and procedures that implement these

laws and executive orders. These are contained in Parts 112, 113, and 117 of Title 13 of the Code of Federal Regulations and in Standard Operating

Procedures.

Privacy Act (5 U.S.C. 552a) -- Under the provisions of the Privacy Act, you are not required to provide your social security number. Failure to

provide your social security number may not affect any right, benefit or privilege to which you are entitled. Disclosures of name and other personal

identifiers are, however, required for a benefit, as SBA requires an individual seeking assistance from SBA to provide it with sufficient information

for it to make a character determination. In determining whether an individual is of good character, SBA considers the person’s integrity, candor,

and disposition toward criminal actions. Additionally, SBA is specifically authorized to verify your criminal history, or lack thereof, pursuant to

section 7(a)(1)(B), 15 USC Section 636(a)(1)(B) of the Small Business Act ( the Act). Further, for all forms of assistance, SBA is authorized to

make all investigations necessary to ensure that a person has not engaged in acts that violate or will violate the Act or the Small Business

Investment Act, 15 USC Sections 634(b)(11) and 687(b)(a), respectively. For these purposes, you are asked to voluntarily provide your social

security number to assist SBA in making a character determination and to distinguish you from other individuals with the same or similar name or

other personal identifier.

Any person can request to see or get copies of any personal information that SBA has in his or her file when that file is retrieved by individual

identifiers such as name or social security numbers. Requests for information about another party may be denied unless SBA has the written

permission of the individual to release the information to the requestor or unless the information is subject to disclosure under the Freedom of

Information Act.

The Privacy Act authorizes SBA to make certain “routine uses” of information protected by that Act. One such routine use is the disclosure of

information maintained in SBA’s system of records when this information indicates a violation or potential violation of law, whether civil, criminal,

or administrative in nature. Specifically, SBA may refer the information to the appropriate agency, whether Federal, State, local or foreign, charged

with responsibility for, or otherwise involved in investigation, prosecution, enforcement or prevention of such violations. Another routine use is

disclosure to other Federal agencies conducting background checks; only to the extent the information is relevant to the requesting agencies'

function. See, 74 F.R. 14890 (2009), and as amended from time to time for additional background and other routine uses.

Right to Financial Privacy Act of 1978 (12 U.S.C. 3401) -- This is notice to you as required by the Right to Financial Privacy Act of 1978, of

SBA's access rights to financial records held by financial institutions that are or have been doing business with you or your business, including any

financial institutions participating in a loan or loan guaranty. The law provides that SBA shall have a right of access to your financial records in

connection with its consideration or administration of assistance to you in the form of a Government guaranteed loan. SBA is required to provide a

certificate of its compliance with the Act to a financial institution in connection with its first request for access to your financial records, after which

no further certification is required for subsequent accesses. The law also provides that SBA's access rights continue for the term of any approved

loan guaranty agreement. No further notice to you of SBA's access rights is required during the term of any such agreement. The law also

authorizes SBA to transfer to another Government authority any financial records included in an application for a loan, or concerning an approved

loan or loan guarantee, as necessary to process, service or foreclose on a loan guaranty or collect on a defaulted loan guaranty.

Freedom of Information Act (5 U.S.C. 552) -- This law provides, with some exceptions, that SBA must supply information reflected in agency

files and records to a person requesting it. Information about approved loans that will be automatically released includes, among other things,

statistics on our loan programs (individual borrowers are not identified in the statistics) and other information such as the names of the borrowers

(and their officers, directors, stockholders or partners), the collateral pledged to secure the loan, the amount of the loan, its purpose in general terms

and the maturity. Proprietary data on a borrower would not routinely be made available to third parties. All requests under this Act are to be

addressed to the nearest SBA office and be identified as a Freedom of Information request.

Flood Disaster Protection Act (42 U.S.C. 4011) -- Regulations have been issued by the Federal Insurance Administration (FIA) and by SBA

implementing this Act and its amendments. These regulations prohibit SBA from making certain loans in an FIA designated floodplain unless

Federal Flood insurance is purchased as a condition of the loan. Failure to maintain the required level of flood insurance makes the applicant

ineligible for any financial assistance from SBA, including disaster assistance.

Executive Orders -- Floodplain Management and Wetland Protection (42 F.R. 26951 and 42 F.R. 26961) -- SBA discourages settlement in or

development of a floodplain or a wetland. This statement is to notify all SBA loan applicants that such actions are hazardous to both life and

property and should be avoided. The additional cost of flood preventive construction must be considered in addition to the possible loss of all assets

and investments due to a future flood.

Occupational Safety and Health Act (15 U.S.C. 651 et seq.) -- This legislation authorizes the Occupational Safety and Health Administration in

the Department of Labor to require businesses to modify facilities and procedures to protect employees or pay penalty fees. Businesses can be

forced to cease operations or be prevented from starting operations in a new facility. Therefore, SBA may require additional information from an

applicant to determine whether the business will be in compliance with OSHA regulations and allowed to operate its facility after the loan is

approved and disbursed. Signing this form as an applicant is certification that the OSHA requirements that apply to the applicant business have been

determined and that the applicant, to the best of its knowledge, is in compliance. Furthermore, applicant certifies that it will remain in compliance

during the life of the loan.

SBA Form 1919 (05/17)

6

1

1 2

2 3

3 4

4 5

5 6

6 7

7