Form Gid-207-Pt Oct08 - Georgia Job Tax Credit - Insurance Department Page 4

ADVERTISEMENT

OFFICE OF COMMISSIONER OF INSURANCE

COMMISSIONER OF INSURANCE •INDUSTRIAL LOAN COMMISSIONER•SAFETY FIRE COMMISSIONER•COMPTROLLER GENERAL

John W. Oxendine, Commissioner

2 Martin Luther King Jr., Dr., Suite 916, West Tower, Atlanta, GA 30334

Phone 404-656-7553

PREMIUM TAX

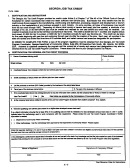

GEORGIA JOB TAX CREDIT

GID-207-PT OCT08

B. INSTRUCTIONS

Part I

In order to complete Part A (CERTIFICATION AND INSTRUCTIONS) and the remainder of GID-207-PT, the taxpayer must be familiar

with the law and regulations. Applicable law includes O.C.G.A. 33-8-4.1. Other law may be applicable depending on taxpayer

circumstances. Applicable regulations include regulations issued by the Georgia Department of Community Affairs (Rules 110-9-1-.02,

and 110-9-1-.03.)

Part II

Provide the information requested on the number of full-time jobs at the end of each month based on the calendar year. (See regulations

issued by the Georgia Department of Community Affairs for further information.)

Part III-V

Year 1 is the tax year of new jobs increase and the Prior Year is the preceding tax year. (See Rule 110-9-1-.01 of the Job Tax Credit

Program Regulations for the definition of these and other terms)

Line 1

Total employees is the total of full-time employees subject to Georgia income tax withholding at the end of each applicable

monthly reporting period.

Line 2

Number of months of operation in each tax year (usually 12).

Line 3

Monthly average of full-time employees (line 1 divided by line 2). Round to the nearest whole number.

Line 4

Previous year’s monthly average from line 3.

Line 5

Average increase (decrease) in full-time employees (line 3 less line 4).

Line 6-11

Enter the appropriate average increase if maintained. See Rule 110-9-1-.03 of the Job Tax Credit Program Regulations for

detailed instructions.

Line 12

Number of jobs eligible for credit equals the total of lines 6-11.

Line 13

Multiply line 12 by $3,500, $2,500, $1,250 or $750 depending on whether the business created jobs in a tier 1 county ($3,500),

tier 2 county ($2,500), tier 3 county ($1,250 credit), or tier 4 county ($750 credit) and add to this figure the amount of any

unused credits from previous years. (The unused credit amounts may not include credits that have expired.) Note that if jobs

on Line 12 were created in different years, credit amounts per job may vary depending on the credit amounts applicable in the

years the jobs were created. See the Job Tax Credit Regulations for further details.

Line 14

Enter the amount of tax liability for this tax year before any Job Tax Credit.

Line 15

Enter 50% of line 14 (for tier 3 or 4) or 100% of line 14 (for tier 1 or 2).

Line 16

Enter the lesser of line 15 or line 13. (Amount of Job Tax Credit for current year)

Line 17

Enter the amount of unused tax credits that may be carried forward: Line 16 minus line 13. Unused tax credits may be carried

forward for 10 years from the close of the tax year in which the qualified jobs were established. Use the FIFO method to

determine which tax credits expire at what time. See the Job Tax Credit Regulations for further details.

NOTE:

The tax credit is calculated on the basis of the average number of new full-time jobs created by county area by taxpayer.

Before any credit can be received, a business must create at least an average of 5 (tier 1 county), 10 (2 tier county), 15 or 25

(4 tier county) new full-time jobs in an eligible county. The creation of 5, 10, 15, or 25 jobs in two or more counties does not

meet job threshold requirements.

The Office of Insurance and Safety Fire Commissioner does not discriminate by race, color, national origin, sex, religion, age or disability in the employment or the provision

Page 4 of 4

of programs or services. Persons with disabilities needing this document in another format can contact the ADA Coordinator, Office of the Commissioner of Insurance at No. 2

Martin Luther King Jr., Dr., Suite 620, Atlanta, GA 30334 - Phone 404-656-2056

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4