Sba Form 413 - Personal Financial Statement Page 2

ADVERTISEMENT

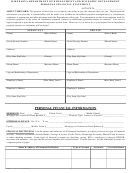

Section 2. Notes Payable to Banks and Others. (Use attachments if necessary. Each attachment must be identified as a part of this statement and signed.)

Original

Current

Payment

Frequency

How Secured or Endorsed

Name and Address of Noteholder(s)

Balance

Balance

Amount

(monthly,etc.)

Type of Collateral

Section 3. Stocks and Bonds. (Use attachments if necessary. Each attachment must be identified as a part of this statement and signed).

Market Value

Date of

Number of Shares

Name of Securities

Cost

Total Value

Quotation/Exchange

Quotation/Exchange

(List each parcel separately. Use attachment if necessary. Each attachment must be identified as a part of this

Section 4. Real Estate Owned.

statement and signed.)

Property A

Property B

Property C

Type of Real Estate (e.g. Primary

Residence, Other Residence, Rental

Property, Land, etc.)

Address

Date Purchased

Original Cost

Present Market Value

Name &

Address of Mortgage Holder

Mortgage Account Number

Mortgage Balance

Amount of Payment per Month/

Year

Status of Mortgage

(Describe, and if any is pledged as security, state name and address of lien holder, amount of lien, terms

Section 5. Other Personal Property and Other Assets.

of payment and if delinquent, describe delinquency)

Section 6.

Unpaid Taxes.

(Describe in detail, as to type, to whom payable, when due, amount, and to what property, if any, a tax lien attaches.)

Section 7.

Other Liabilities.

(Describe in detail.)

SBA Form 413 (05-12) Previous Editions Obsolete

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5