Sba Form 413 - Personal Financial Statement Page 3

ADVERTISEMENT

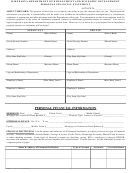

Section 8.

Life Insurance Held.

(Give face amount and cash surrender value of policies - name of insurance company and beneficiaries)

I authorize SBA/Lender to make inquiries as necessary to verify the accuracy of the statements made and to determine my creditworthiness.

CERTIFICATION: (to be completed by each person submitting the information requested on this form)

By signing this form, I certify under penalty of criminal prosecution that all information on this form and any additional supporting information submitted

with this form is true and complete to the best of my knowledge. I understand that SBA or its participating Lenders, or Certified Development Companies

will rely on this information when making decisions regarding an application for a loan from SBA or an SBA Participating Lender, or for participation in

the SBA 8(a) Business Development (BD) program.

Signature

Date

Print Name

Social Security No.

Signature

Date

Print Name

Social Security No.

NOTICE TO LOAN APPLICANTS: CRIMINAL PENALTIES AND ADMINISTRATIVE REMEDIES FOR FALSE STATEMENTS:

Knowingly making a false statement on this form is a violation of Federal law and could result in criminal prosecution, significant civil penalties, and a

denial of your loan. A false statement is punishable under 18

U.S.C.

§§ 1001 and 3571 by imprisonment of not more than five years and/or a fine of up to

$250,000; under 15

U.S.C.

§ 645 by imprisonment of not more than two years and/or a fine of not more than $5,000; and, if submitted to a Federally

insured institution, a false statement is punishable under 18

U.S.C.

§ 1014 by imprisonment of not more than 30 years and/or a fine of not more than

$1,000,000.

NOTICE TO APPLICANTS OR PARTICIPANTS IN THE 8(a) BD PROGRAM: CRIMINAL PENALTIES AND ADMINISTRATIVE REMEDIES FOR

FALSE STATEMENTS:

Any person who misrepresents a business concern's status as an 8(a) Program participant or SDB concern, or makes any other false statement in order

to influence the 8(a) certification or other review process in any way (e.g., annual review, eligibility review), shall be: (1) Subject to fines and imprisonment

of up to 5 years, or both, as stated in Title 18 U.S.C. § 1001; (2) subject to fines of up to $500,000 or imprisonment of up to 10 years, or both, as stated in

Title 15 U.S.C. § 645; (3) Subject to civil and administrative remedies, including suspension and debarment; and (4) Ineligible for participation in

programs conducted under the authority of the Small Business Act.

PLEASE NOTE:

The estimated average burden hours for the completion of this form is 1.5 hours per response. If you have questions or comments

concerning this estimate or any other aspect of this information, please contact Chief, Administrative Branch, U.S. Small Business

Administration, Washington, D.C. 20416, and Clearance Officer, Paper Reduction Project (3245-0188), Office of Management and

Budget, Washington, D.C. 20503. PLEASE DO NOT SEND FORMS TO OMB.

SBA Form 413 (05-12) Previous Editions Obsolete

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5