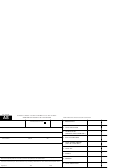

COUNTY/STADIUM SALES TAX

SCHEDULE CT-12X

(See instructions for completing this schedule. Leave lines blank if no receipts to report; do not enter zeros.)

The county tax effective date follows the name of the county. The stadium tax is effective January 1, 1996.

Receipts Subject to Stadium Sales Tax

COUNTY

Receipts Subject to County Sales Tax

Period Ending

Period Ending

Period Ending

Period Ending

Period Ending

Period Ending

________ 19 ____

________ 19 ____

NAME

CODE

________ 19 ____

________ 19 ____

________ 19 ____

________ 19 ____

ADAMS (01-94) ..............

01

ASHLAND (04-88) .........

02

BARRON (04-86) ...........

03

BAYFIELD (04-91) .........

04

BUFFALO (04-87) ..........

06

BURNETT (04-89) ..........

07

CHIPPEWA (04-91) .......

09

COLUMBIA (04-89) ........

11

CRAWFORD (04-91) .....

12

DANE (04-91) .................

13

DODGE (04-94) .............

14

DOOR (04-88) ................

15

DOUGLAS (04-91) .........

16

DUNN (04-86) ................

17

FOREST (04-95) ............

21

IOWA (04-87) .................

25

IRON (04-91) ..................

26

JACKSON (04-87) ..........

27

JEFFERSON (04-91) .....

28

JUNEAU (04-92) ............

29

KENOSHA (04-91) .........

30

LA CROSSE (04-90) ......

32

LANGLADE (04-88) .......

34

LINCOLN (04-87) ...........

35

MARATHON (04-87) ......

37

MARQUETTE (04-89) ....

39

MILWAUKEE (04-91) ....

40

MONROE (04-90) ..........

41

OCONTO (07-94) ...........

42

ONEIDA (04-87) .............

43

OZAUKEE (04-91) .........

45

PEPIN (04-91) ................

46

PIERCE (04-88) .............

47

POLK (04-88) .................

48

PORTAGE(04-89) ..........

49

PRICE (01-93) ................

50

RACINE (N/A) ................

51

RICHLAND(04-89) .........

52

RUSK (04-87) .................

54

ST CROIX (04-87) ..........

55

SAUK (04-92) .................

56

SAWYER (04-87) ...........

57

SHAWANO (04-90) ........

58

TREMPEALEAU (10-95)

61

VERNON (01-97) ...........

62

VILAS (04-88) ................

63

WALWORTH (04-87) .....

64

WASHBURN (04-91) ......

65

WASHINGTON (N/A) .....

66

WAUKESHA (N/A) .........

67

WAUPACA (04-89) ........

68

WAUSHARA (04-90) ......

69

A. TOTAL

B. 0.5% County Sales Tax (line A times

.005; Enter on line 12b.)

C. 0.1% Stadium Sales Tax (line A times

.001; Enter on line 12c)

Page 3

1

1 2

2 3

3 4

4