Form Mo-1040 And Mo-A Instructions - Missouri Department Of Revenue - 2006 Page 17

ADVERTISEMENT

Use this worksheet to help you determine the correct amount to be entered on Form MO-1040, Lines 1Y and 1S.

Click the button on the worksheet to prepopulate the amounts on Form MO-1040, Lines 1Y and 1S.

Use results from this worksheet in MO-1040, Line 1.

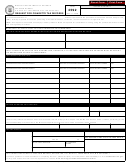

WORKSHEET FOR FORM MO-1040, LINE 1

Reset

Instructions for Completing the Adjusted Gross Income Worksheet

Missouri law requires a combined return for spouses filing together. A combined

social security benefits must be allocated between each spouse's share of the ben-

return means taxpayers are required to split their total federal adjusted gross

efits received for the year.

income (including other state income) between spouses when beginning the

The worksheet below lists income that is included on your federal return, along with

Missouri return.

federal line references. Find the lines that apply to your federal return, split the

Splitting the income can be as easy as adding up your separate Form W-2s and

income between you and your spouse, and enter the amounts on the worksheet.

1099s. Or it may require more calculating by allocating to each spouse the percent-

When you have completed the worksheet, transfer the amounts from Line 18 to

age of ownership in jointly held property, such as businesses, farm operations, div-

Form MO-1040, Lines 1Y and 1S.

idends, interest, rent, and capital gains or losses. State refunds should be split

Note: Remember, the incomes listed separately on Line 18 of this worksheet must

based on each spouse's 2005 Missouri tax withheld, less each spouse's 2005 tax

equal your total federal adjusted gross income when added together.

liability. The result should be each spouse's portion of the 2005 refund. Taxable

Adjusted Gross Income Worksheet

Federal

Federal

Federal

Y — Yourself

Form 1040EZ

Form 1040A

Form 1040

S — Spouse

for Combined Return

Line Number

Line Number

Line Number

1. Wages, salaries, tips, etc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

7

7

00

1

00

2. Taxable interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

8a

8a

00

2

00

3. Dividend income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

9a

9a

00

3

00

4. State and local income tax refunds . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

10

00

4

00

5. Alimony received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

11

00

5

00

6. Business income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

12

00

6

00

7. Capital gain or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

10

13

00

7

00

8. Other gains or (losses) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

14

00

8

00

9. Taxable IRA distributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

11b

15b

00

9

00

10. Taxable pensions and annuities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

12b

16b

00

10

00

11. Rents, royalties, partnerships, S corporations, trusts, etc. . . . . . . . . . .

none

none

17

00

11

00

12. Farm income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

18

00

12

00

13. Unemployment compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

13

19

00

13

00

14. Taxable social security benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

14b

20b

00

14

00

15. Other income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

21

00

15

00

0

16. Total (add Lines 1 through 15) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

15

22

00

16

0

00

17. Less: federal adjustments to income . . . . . . . . . . . . . . . . . . . . . . . . . .

none

20

36

00

17

00

18. Federal adjusted gross income (Line 16 less Line 17)

0

0

Enter amounts here and on Lines 1Y and 1S, Form MO-1040 . . . . . . . .

4

21

37

00

18

00

Back to MO-1040, page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17