Reset

Print

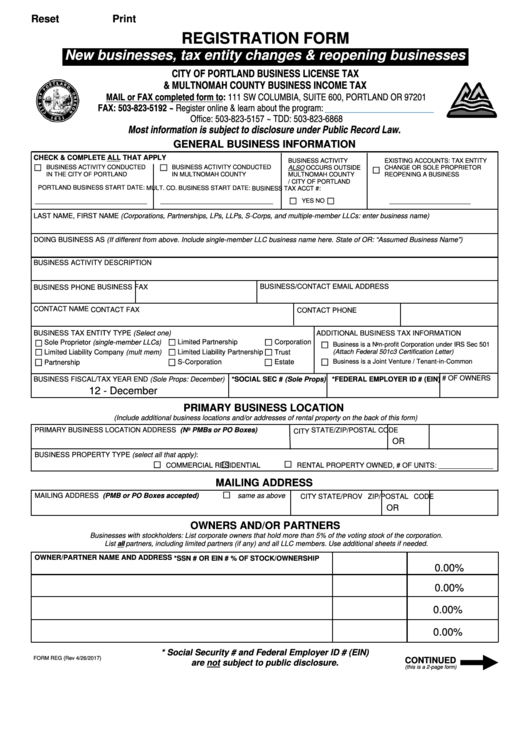

REGISTRATION FORM

New businesses, tax entity changes & reopening businesses

CITY OF PORTLAND BUSINESS LICENSE TAX

& MULTNOMAH COUNTY BUSINESS INCOME TAX

MAIL or FAX completed form to: 111 SW COLUMBIA, SUITE 600, PORTLAND OR 97201

FAX: 503-823-5192 ~ Register online & learn about the program:

Office: 503-823-5157 ~ TDD: 503-823-6868

Most information is subject to disclosure under Public Record Law.

GENERAL BUSINESS INFORMATION

CHECK & COMPLETE ALL THAT APPLY

BUSINESS ACTIVITY

EXISTING ACCOUNTS: TAX ENTITY

BUSINESS ACTIVITY CONDUCTED

BUSINESS ACTIVITY CONDUCTED

ALSO OCCURS OUTSIDE

CHANGE OR SOLE PROPRIETOR

IN THE CITY OF PORTLAND

IN MULTNOMAH COUNTY

MULTNOMAH COUNTY

REOPENING A BUSINESS

/ CITY OF PORTLAND

PORTLAND BUSINESS START DATE:

MULT. CO. BUSINESS START DATE:

BUSINESS TAX ACCT #:

YES

NO

LAST NAME, FIRST NAME (Corporations, Partnerships, LPs, LLPs, S-Corps, and multiple-member LLCs: enter business name)

DOING BUSINESS AS (If different from above. Include single-member LLC business name here. State of OR: “Assumed Business Name”)

BUSINESS ACTIVITY DESCRIPTION

BUSINESS FAX

BUSINESS/CONTACT EMAIL ADDRESS

BUSINESS PHONE

CONTACT NAME

CONTACT FAX

CONTACT PHONE

BUSINESS TAX ENTITY TYPE (Select one)

ADDITIONAL BUSINESS TAX INFORMATION

Limited Partnership

Corporation

Sole Proprietor (single-member LLCs)

Business is a Non-profit Corporation under IRS Sec 501

Limited Liability Partnership

Trust

(Attach Federal 501c3 Certification Letter)

Limited Liability Company (mult mem)

S-Corporation

Business is a Joint Venture / Tenant-in-Common

Partnership

Estate

BUSINESS FISCAL/TAX YEAR END (Sole Props: December) *SOCIAL SEC # (Sole Props) *FEDERAL EMPLOYER ID # (EIN) # OF OWNERS

12 - December

PRIMARY BUSINESS LOCATION

(Include additional business locations and/or addresses of rental property on the back of this form)

PRIMARY BUSINESS LOCATION ADDRESS (No PMBs or PO Boxes)

STATE/

ZIP/POSTAL CODE

CITY

OR

BUSINESS PROPERTY TYPE (select all that apply):

COMMERCIAL

RESIDENTIAL

RENTAL PROPERTY OWNED, # OF UNITS: ______________

MAILING ADDRESS

MAILING ADDRESS (PMB or PO Boxes accepted)

same as above

STATE/PROV ZIP/POSTAL CODE

CITY

OR

OWNERS AND/OR PARTNERS

Businesses with stockholders: List corporate owners that hold more than 5% of the voting stock of the corporation.

List all partners, including limited partners (if any) and all LLC members. Use additional sheets if needed.

OWNER/PARTNER NAME AND ADDRESS

*SSN # OR EIN #

% OF STOCK/OWNERSHIP

0.00%

0.00%

0.00%

0.00%

* Social Security # and Federal Employer ID # (EIN)

FORM REG (Rev 4/26/2017)

CONTINUED

are not subject to public disclosure.

(this is a 2-page form)

1

1 2

2