Reset

Print

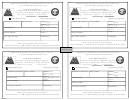

ADDITIONAL BUSINESS LOCATIONS AND/OR RENTAL PROPERTY OWNED

Attach additional sheet(s) if needed)

(

BUSINESS NAME

BUSINESS DESCRIPTION

ADDRESS

STATE/PROV

ZIP/POSTAL CODE

CITY

OR

CHECK ALL THAT APPLY

THIS IS AN ADDITIONAL

RENTAL PROPERTY OWNED,

OWNED RENTAL PROPERTY

# OF UNITS: ______________

BUSINESS LOCATION

COMMERCIAL

RESIDENTIAL

BUSINESS NAME

BUSINESS DESCRIPTION

ADDRESS

STATE/PROV

ZIP/POSTAL CODE

CITY

OR

CHECK ALL THAT APPLY

RENTAL PROPERTY OWNED,

OWNED RENTAL PROPERTY

THIS IS AN ADDITIONAL

BUSINESS LOCATION

# OF UNITS: ______________

COMMERCIAL

RESIDENTIAL

INSTRUCTIONS: New businesses are required to register with the City of Portland and Multnomah County. Existing

businesses changing their tax entity, and sole proprietors/single-member LLCs reopening their business should also

complete this form and provide their Business License Tax account number. The business name, taxpayer ID #, entity

type, etc. should match the federal/Oregon tax return on which the single-member LLC’s income is directly reported.

Single-member LLCs should not register or file in the LLC’s name. The name of the single-member LLC should be

included on the “Doing Business As” line. Spouses who jointly file their IRS/Oregon individual tax return are required to

file a joint City/County return as well. Only one Registration Form should be completed. Include the name and SSN of

the second spouse in the OWNERS AND/OR PARTNERS section of this form. Most information is subject to disclosure

under Public Record Law.

NO PAYMENT IS DUE WITH THIS FORM

To remain in compliance you must file a City/County tax return

EACH YEAR when you file your federal and state returns.

All required forms may be found at

NOTICE OF CONFIDENTIALITY

All tax returns and related financial information, including a Taxpayer ID #, filed with the City of Portland are

confidential. Except as provided by PCC 7.02.230, .240, and .250, it is unlawful to divulge or release any

information submitted or disclosed to the City.

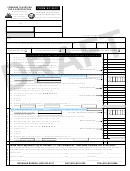

SIGNATURE

The undersigned declares under penalty of making a false statement, that the information given in this form is true.

____________________________________________________

_____________________________________

_______________________

Signature of Registrant or Authorized Representative

Title

Date

MAIL or FAX completed form to: City of Portland, 111 SW COLUMBIA, SUITE 600, PORTLAND OR 97201 ~ FAX: 503-823-5192

Reset

Print

OFFICIAL USE ONLY

Date Received

Entry Date

NAICS

1

1 2

2