Payroll Tax Checklist For Ministries

ADVERTISEMENT

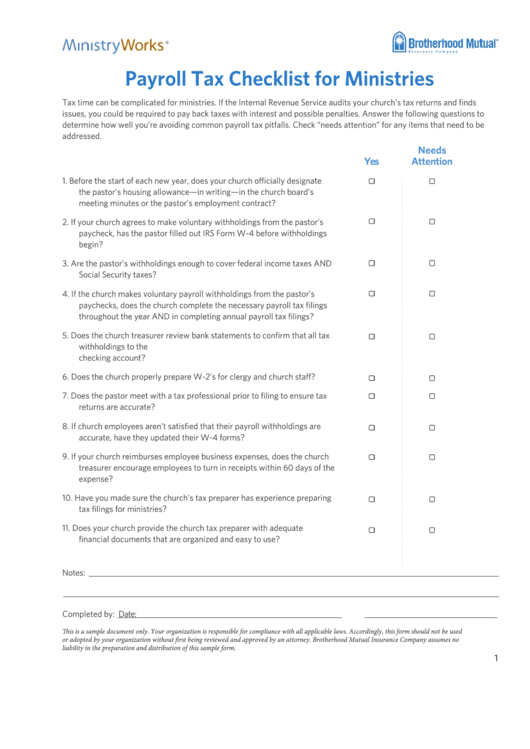

Payroll Tax Checklist for Ministries

Tax time can be complicated for ministries. If the Internal Revenue Service audits your church’s tax returns and finds

issues, you could be required to pay back taxes with interest and possible penalties. Answer the following questions to

determine how well you’re avoiding common payroll tax pitfalls. Check “needs attention” for any items that need to be

addressed.

Needs

Yes

Attention

1. Before the start of each new year, does your church officially designate

the pastor’s housing allowance—in writing—in the church board’s

meeting minutes or the pastor’s employment contract?

2. If your church agrees to make voluntary withholdings from the pastor’s

paycheck, has the pastor filled out IRS Form W-4 before withholdings

begin?

3. Are the pastor’s withholdings enough to cover federal income taxes AND

Social Security taxes?

4. If the church makes voluntary payroll withholdings from the pastor’s

paychecks, does the church complete the necessary payroll tax filings

throughout the year AND in completing annual payroll tax filings?

5. Does the church treasurer review bank statements to confirm that all tax

withholdings to the U.S. Treasury have been withdrawn from the church

checking account?

6. Does the church properly prepare W-2’s for clergy and church staff?

7. Does the pastor meet with a tax professional prior to filing to ensure tax

returns are accurate?

8. If church employees aren’t satisfied that their payroll withholdings are

accurate, have they updated their W-4 forms?

9. If your church reimburses employee business expenses, does the church

treasurer encourage employees to turn in receipts within 60 days of the

expense?

10. Have you made sure the church’s tax preparer has experience preparing

tax filings for ministries?

11. Does your church provide the church tax preparer with adequate

financial documents that are organized and easy to use?

Notes:

Completed by:

Date:

This is a sample document only. Your organization is responsible for compliance with all applicable laws. Accordingly, this form should not be used

or adopted by your organization without first being reviewed and approved by an attorney. Brotherhood Mutual Insurance Company assumes no

liability in the preparation and distribution of this sample form.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Life

1

1