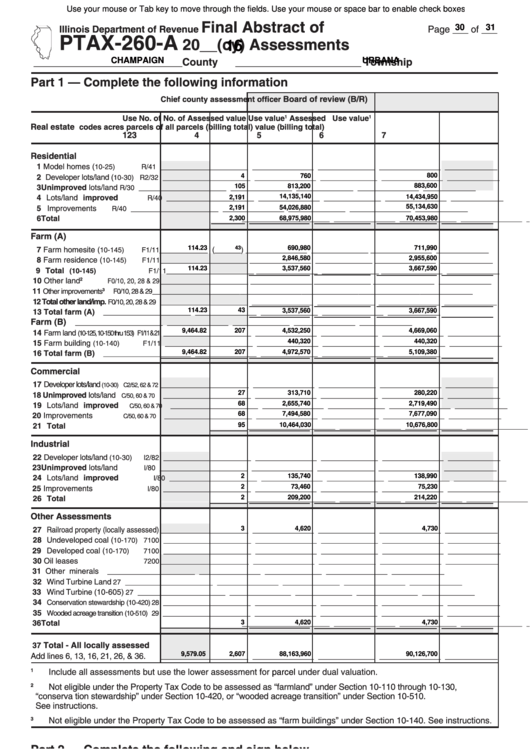

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Final Abstract of

Illinois Department of Revenue

Page ___ of ___

30

31

PTAX-260-A

20__(cy) Assessments

16

__________________________County

______________________ Township

CHAMPAIGN

URBANA

Part 1 — Complete the following information

Board of review (B/R)

Chief county assessment officer

Use

No. of

No. of

Assessed value

Use value

Assessed

Use value

1

1

Real estate

codes

acres

parcels

of all parcels

(billing total)

value

(billing total)

1

2

3

4

5

6

7

Residential

1 Model homes (

____________________ ______________ _____________ ______________ ____________

10-25)

R/41

2 Developer lots/land (

____________________ ______________ _____________ ______________ ____________

800

10-30) R2/32

4

760

3 Unimproved lots/land

____________________ ______________ _____________ ______________ ____________

883,600

R/30

105

813,200

4 Lots/land improved

____________________ ______________ _____________ ______________ ____________

R/40

14,135,140

14,434,950

2,191

5 Improvements

____________________ ______________ _____________ ______________ ____________

55,134,630

R/40

2,191

54,026,880

6 Total

____________________ ______________ _____________ ______________ ____________

70,453,980

2,300

68,975,980

Farm (A)

7 Farm homesite (

___________ (______) ______________ _____________ ______________ ____________

114.23

690,980

711,990

10-145)

F1/11

43

8 Farm residence (

____________________ ______________ _____________ ______________ ____________

2,846,580

2,955,600

10-145)

F1/11

9 Total

____________________ ______________ _____________ ______________ ____________

114.23

3,537,560

3,667,590

(10-145)

F1/11

10 Other land

2

____________________ ______________ _____________ ______________ ____________

F0/10, 20, 28 & 29

11

____________________ ______________ _____________ ______________ ____________

Other improvements

3

F0/10, 28 & 29

12 Total other land/imp.

____________________ ______________ _____________ ______________ ____________

F0/10, 20, 28 & 29

13 Total farm (A)

____________________ ______________ _____________ ______________ ____________

114.23

43

3,537,560

3,667,590

Farm (B)

____________________ ______________ _____________ ______________ ____________

14 Farm land

____________________ ______________ _____________ ______________ ____________

9,464.82

207

4,532,250

4,669,060

(10-125, 10-150 thru 153) F1/11 & 21

15 Farm building

____________________ ______________ _____________ ______________ ____________

440,320

440,320

(10-140)

F1/11

16 Total farm (B)

____________________ ______________ _____________ ______________ ____________

9,464.82

207

4,972,570

5,109,380

Commercial

17 Developer lots/land

____________________ ______________ _____________ ______________ ____________

(10-30) C2/52, 62 & 72

18 Unimproved lots/land

____________________ ______________ _____________ ______________ ____________

27

313,710

280,220

C/50, 60 & 70

19 Lots/land improved

____________________ ______________ _____________ ______________ ____________

68

2,655,740

2,719,490

C/50, 60 & 70

20 Improvements

____________________ ______________ _____________ ______________ ____________

68

7,494,580

7,677,090

C/50, 60 & 70

21 Total

____________________ ______________ _____________ ______________ ____________

95

10,464,030

10,676,800

Industrial

22 Developer lots/land

____________________ ______________ _____________ ______________ ____________

(10-30)

I2/82

23 Unimproved lots/land

____________________ ______________ _____________ ______________ ____________

I/80

24 Lots/land improved

____________________ ______________ _____________ ______________ ____________

2

135,740

138,990

I/80

25 Improvements

____________________ ______________ _____________ ______________ ____________

2

73,460

75,230

I/80

26 Total

____________________ ______________ _____________ ______________ ____________

2

209,200

214,220

Other Assessments

27 Railroad property (locally assessed) ____________________ ______________ _____________ ______________ ____________

3

4,620

4,730

28 Undeveloped coal (

____________________ ______________ _____________ ______________ ____________

10-170) 7100

29 Developed coal (

____________________ ______________ _____________ ______________ ____________

10-170)

7100

30 Oil leases

____________________ ______________ _____________ ______________ ____________

7200

31 Other minerals

____________________ ______________ _____________ ______________ ____________

32 Wind Turbine Land

____________________ ______________ _____________ ______________ ____________

27

33 Wind Turbine (10-605)

____________________ ______________ _____________ ______________ ____________

27

34

____________________ ______________ _____________ ______________ ____________

Conservation stewardship

(10-420) 28

35

Wooded acreage transition

____________________ ______________ _____________ ______________ ____________

(10-510) 29

36 Total

____________________ ______________ _____________ ______________ ____________

3

4,620

4,730

Total - All locally assessed

37

Add lines 6, 13, 16, 21, 26, & 36.

____________________ ______________ _____________ ______________ ____________

9,579.05

2,607

88,163,960

90,126,700

Include all assessments but use the lower assessment for

parcel

under dual valuation.

1

2

Not eligible under the Property Tax Code to be assessed as “farmland” under Section 10-110 through 10-130,

“conserva tion stewardship” under Section 10-420, or “wooded acreage transition” under Section 10-510.

See instructions.

Not eligible under the Property Tax Code to be assessed as “farm buildings” under Section 10-140. See instructions.

3

Part 2 — Complete the following and sign below

Number of exempt non-homestead parcels:__________

38

42

Date assessment books were certified to you by the board of review. __ __ / __ __ / __ __ __ __

39

Month

Day

Year

I certify that this is an abstract of the 20__ (cy) assessed valuations recorded in the assessment books, after all board of review

16

action, including equalization, as received from the board of review.

__ __ / __ __ / __ __ __ __

_______________________________________________

County clerk’s signature

Date

(cy = current year)

PTAX-260-A (R-05/16)

1

1 2

2