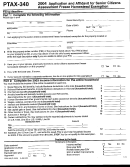

Form PTAX-260-A

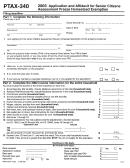

or Wooded Acreage Assessment Transition Laws, 29.

Line 11: Include the A/V of the improvements classified as FO/

General Information

10, 28, and 29. These amounts are included in the compu-

Form PTAX-260-A, Final Abstract of Current Year Assessments,

tation of the state equalization factor.

must be

Line 12: Add Lines 10 and 11.

• filed with the Department within 30 days after receiving

Line 13: Total Farm (A)

the assessment books from the board of review.

• Column 3 — Add Lines 10 and 11. Do not include

• completed for each township and for the entire county.

parcels used for residential, commercial, or industrial

If your county does not have township organization and

purposes in this subcategory.

the assessor’s books are kept by congressional township

• Columns 4 through 7 — Add Lines 9 and 12.

or precinct, you must file a separate Form PTAX-260-A

Farm (B)

for each area.

Line 14: Include parcels assessed under 10-125 (Farmland

ILLINOIS DEPARTMENT OF REVENUE

• mail to:

Assessment Law), classified as farmland, F1/11 and 21.

PO BOX 19033

SPRINGFIELD IL 62794-9033

Line 15: Include parcels assessed under 10-140 (Farmland

Assessment Law), classified as farm buildings, F1/11.

If an error is discovered during the assessment year

after Form PTAX-260-A has been filed, a revised

Line 16: Add Lines 14 and 16. These amounts are not

Form PTAX-260-A must be filed with the department.

included in the computation of the state equalization factor.

Specific Instructions

Commercial

Line 17 — Developer lots (10-30) - C2/52, 62, 72

Part 1

Line 18 — Unimproved lot/land - C/50, 60, 70

Column 2 — No. of acres

Line 19 — Lot/land improved - C/50, 60, 70

Write the number of acres on the applicable line.

Line 20 — Improvements only - C/50, 60, 70

Column 3 — No. of parcels

Line 21 — Add Lines 17 through 20.

Do not include exempt parcels. If the number of parcels

Industrial

in each subcategory does not equal the category total,

Line 22 — Developer lots - (10-30) - 12/82

explain in the notes area at the bottom of this page.

Line 23 — Unimproved lot/land - 1/80

Column 4 — Assessed value

Line 24 — Lot/land improved - 1/80

As certified to the board of review. Amounts should include

Line 25 — Improvements only - 1/80

the higher assessment for parcels under dual valuation.

Line 26 — Add Lines 22 through 25.

Column 5 — Use value

(billing total)

1

Total assessed values for parcels using the lower

Other Assessments

assessment for parcels under dual valuation and for those

Line 27 — Railroad property (locally assessed)

qualified as a “historic building.” This represents the value

Lines 28 & 29 — Coal assessments (10-170) - 7100.

on which the taxes are extended (also called the billing

total). Categories without parcels under dual assessment

These are categorized as undeveloped or developed coal.

will have the same figures reported in Columns 4 and 5.

Line 30 — Oil leases - 7200

Column 6 — Assessed value

Line 31 — Other minerals

As adjusted by the board of review.

Line 32 — Wind Turbine Land

Column 7 — Use value

(billing total)

1

Line 33 — Wind Turbine (10-605)

Total assessed values for all parcels using the lower

Line 34 — Include acres, the parcel count, and the

assessment for parcels under dual valuation. Categories

unimproved A/V of land assessed under 10-420

without parcels under dual assessment will have the same

(Conservation Stewardship Law), classified as 28.

figures reported in Columns 6 and 7.

Line 35 — Include acres, the parcel count, and the

unimproved A/V of land assessed under 10-510 (Wooded

Residential

Acreage Assessment Transition Law), classified as 29.

Line 1 — Include single-family residences, townhomes,

Line 36 — Add Lines 27 through 35.

and condominiums (10-25) - R/41

Line 2 — Developer lots (10-30) - R2/32

Total - All locally assessed

Line 37: Add Lines 6, 13, 16, 21, 26, and 36.

Line 3 — Unimproved lots/land - R/30

Line 4 — Lots/land improved - R/40

Part 2

Line 5 — Improvements - R/40

Line 6 — Add Lines 1 through 5.

Lines 38 and 39: Follow the instructions on the form.

Form PTAX-260-A must be signed by the county clerk

Farm (A)

before sending it to the department.

Lines 7 through 9: Farm homesite, farm residence, and

appurtenant structures (10-145) - F1/11.

Line 10: Include the parcel count and A/V of parcels

classified as F0/10, 20. Include the A/V of improved land

classified as 28 and 29. Do not include the parcel count for

parcels assessed under the Conservation Stewardship, 28,

Notes:

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

This form is authorized as outlined by 35 ILCS 200/1-1 et. seq. Disclosure of this information is REQUIRED.

PTAX-260-A (R-05/16)

Reset

Print

1

1 2

2